Assessments are out, everybody lucky enough to have entered the housing market lottery prior to about 2008 is discovering how much their nest egg has expanded in the last year, and even to the lucky winners, this is at times disconcerting. Strangely enough, people who have just discovered that have an extra couple of hundred thousand dollars in tax-protected equity they didn’t know about are concerned about the impact on their Property Tax. People are funny that way.

I wrote a piece several years ago about how property tax relates to your assessment increase, and last year provided a handy graph showing how your assessment increase vs. the average city-wide assessment increase results in different increases in your taxes.

This year, the Mayor of Coquitlam used Facebook to send essentially the same message, and New West blogger and noted Hawaiian star-coder Canspice wrote another piece with a slightly more updated example of how the system works compared my older one. So I won’t tread over all that again, but short version is your Municipal taxes won’t go up nearly as much as your assessment.

My incredibly average house’s value went up 30% this year, and the average for New Westminster was 28.5%, so my property tax bill will go up 2.5% plus whatever increase Council decides is required to pay the bills in 2017 (now looking to be just under 3%, but not yet confirmed). If your home went up 25.5% in value, your taxes would be exactly the same as last year. If your home went up less than 25%, your taxes are going down.

However (and here is another important point people often miss), this only relates to your Municipal taxes. When Council decides it needs to collect 3% more tax revenue to balance the budget, we adjust the mill rate to increase our revenue by 3%. However, Municipal taxes are only a little more than half of your Property Tax bill. You may remember these line items from last time you paid your taxes:![]()

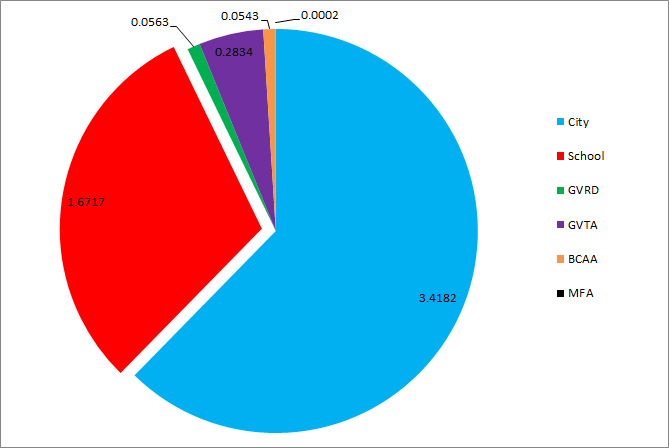

In New West (and this varies between Cities for reasons that will soon become obvious), about 60% of your Property Tax goes to the City, the other 40% goes to other agencies, and the City has no control over what the rates are for those taxes.

The School Taxes (for a New West residential property, this is about 30% of the total you pay) are set by the Provincial government. They are based on a Mil rate, like your Municipal taxes, and like them, the rate is different in every City. Generally cities with higher land values have lower mil rates (West Vancouver is 1.026, Quesnel is 3.698), and the rates are adjusted every year. After that, I honestly have no idea what formula they use or what their goals are towards equity across the Province. According to the Ministry, they are raised every year “based on the previous year’s provincial inflation rate”, but I am not really able to confirm or refute that idea. I have never seen a letter written to the newspaper complaining to the province that School Taxes are going up.

There are also two regional charges attached to your Property Tax bill, again not directly controlled by the Municipality: those to support the operation of Metro Vancouver (GVRD) and TransLink (GVTA).

The Metro tax (Mil rate 0.0563) is solely for regional government operation, and is separate from the utility charges that makes up most of Metro Vancouver’s revenue. The Metro Vancouver board (which is every mayor in the region) negotiates that rate every year based on needs, and it is the same Mil rate across the region, so people in West Vancouver pay much more per household than people in New West, as their property values are higher.

The TransLink Mil rate (currently 0.2834) is determined by the TransLink board, with approval from the provincial government and within the confines of the provincial regulation that governs them. This rate is , again, flat across the region, meaning West Vancouver and Vancouver pay more than New West and Langley per household. This provides about 20% of TransLink’s revenue, and this is the heart of the long battle between the provincial government and the mayors of the region – the Province would prefer that new TransLink revenue to come from increases here, the Mayors have a long list of alternate sources they would prefer, from sales taxes to road pricing to carbon tax. But let’s not go down that rabbit hole just now.

There are also two small charges controlled by the provincial government for the benefit of local governments. The BC Assessment Authority (BCAA), who determines your land value, is funded wholly through Property taxes, and the Municipal Finance Authority (MFA) gains some operational funds through a very small Property Tax charge (20 cents for a $1,000,000 house). Both of these are collected with Mil rates flat across the province, so the average West Vancouver resident pays much more than the average Quesnel resident, with New West somewhere in the middle.

Finally, the City’s new Property Tax Estimator gives you an idea of what your actual assessment means to your tax bill, assuming that Council approves a 2.98% tax increase. It also provides an interesting break-down of how the City’s revenues are distributed between departments, giving you an idea of what you are buying with your Property Tax, and how much you are paying for each.