Once again, a casual conversation I had around a transportation issue led me to look for the data to support my long-held belief. I think I already had this data, as I like to convince myself that data is what most of my long-held beliefs are based on, but I’ve been wrong before, so it never hurts to check yourself, in case you are caught in the same conversation again. Run-on sentences are cool.

In this case, it was a version of the old “There is no need for road pricing, because I already pay for roads through gas taxes” or “Cyclists have no right to the road unless they register and pay a tax” narrative that I was arguing against. The central narrative is that gas-burners pay for roads, ostensibly through Gas Taxes or some other tax that non-drivers don’t pay. My long-held belief has been that gas taxes don’t pay for your roads, nor do ICBC rates or drivers licence renewal fees. The average cyclist likely pays just as much tax as the average car driver, they both pay for the roads (or, more likely, the average cyclist and the average driver are exactly the same person, as pretty much everyone I know who rides a bike also drives a car sometimes… but I digress). It did get me thinking – how much of what the average Lower Mainland driver pays for a car actually goes to maintain the road?

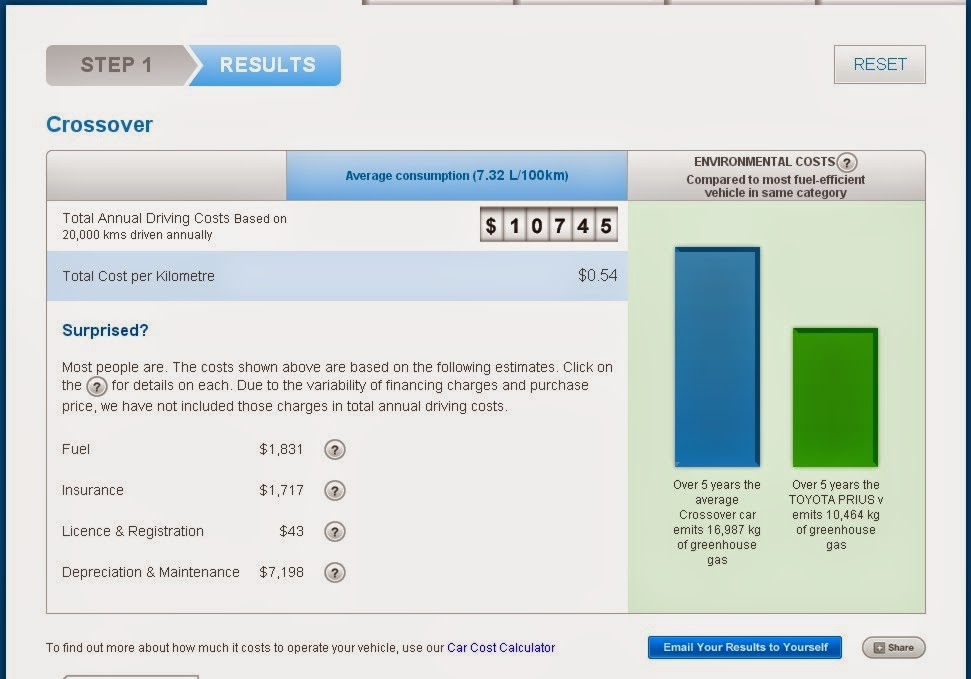

The first part of this is to determine just how much the average Lower Mainlander pays per year to drive the average car. Luckily CAA collects this data on an annual basis, so there is a single source for this number.

|

| Click to make Bigger, borrowed from BCAA, probably illegally. |

Let’s start setting assumptions, lots of people drive compact cars ($9,543 per year) and lots drive SUVs ($12,666 per year), most of the other categories are between these, so let’s pick the vehicle that is closest to the mid-point between these, which is a “Crossover” at $10,745 per year to operate. We have to also assume the average person drives an average amount, and their cost breakdowns are about average. You can see where I am going here, so I am going to try to reduce the use of the word “average” from here on in, and you are not going to use anomalous end-member data to criticize the following analysis. Deal?

|

| Click to make Bigger, borrowed from BCAA, probably illegally. |

According to the Car-Knobbling Council BCAA, your Crossover will cost you about $1,831 a year in fuel, $1,760 in insurance and registration, and about $7,198 (!) in depreciation and maintenance. Neither Esso nor Canadian Tire build roads (excepting, of course, in that they pay taxes, and that goes to roads, but that is true no matter where you spend your money- at the Chevy dealership or the bike shop, so that argument goes nowhere), so we can assume that when we talk about paying for roads through our cars, we are talking about the paying tax for through using things that are part and parcel with using the road. The ICBC part is a special case I’ll have to hit on later, as this is already getting long.

Let’s figure out how much tax you pay to run your car.

For that $1,831 you spend in a year for fuel, the calculator assumes your gas costs you $1.25 per litre, which works out to 1,465 Litres of fuel (I know gas is more expensive now, but I’d rather use numbers from an independent source than make shit up). According to the most independent source I can find, struggling gasoline retailers, $704.42 of this (just over 38%) is taxation at the retail level. This includes $146.50 in Federal excise tax, $97.15 in carbon tax, $249.05 in “transit tax”, $124.53 in Provincial gas tax, and $87.19 in GST.

|

| Per-litre cost of fuel, according to Petro-Canada. Click to read. |

These are each individual revenue streams, so I apologize in advance for the complicated stuff below.

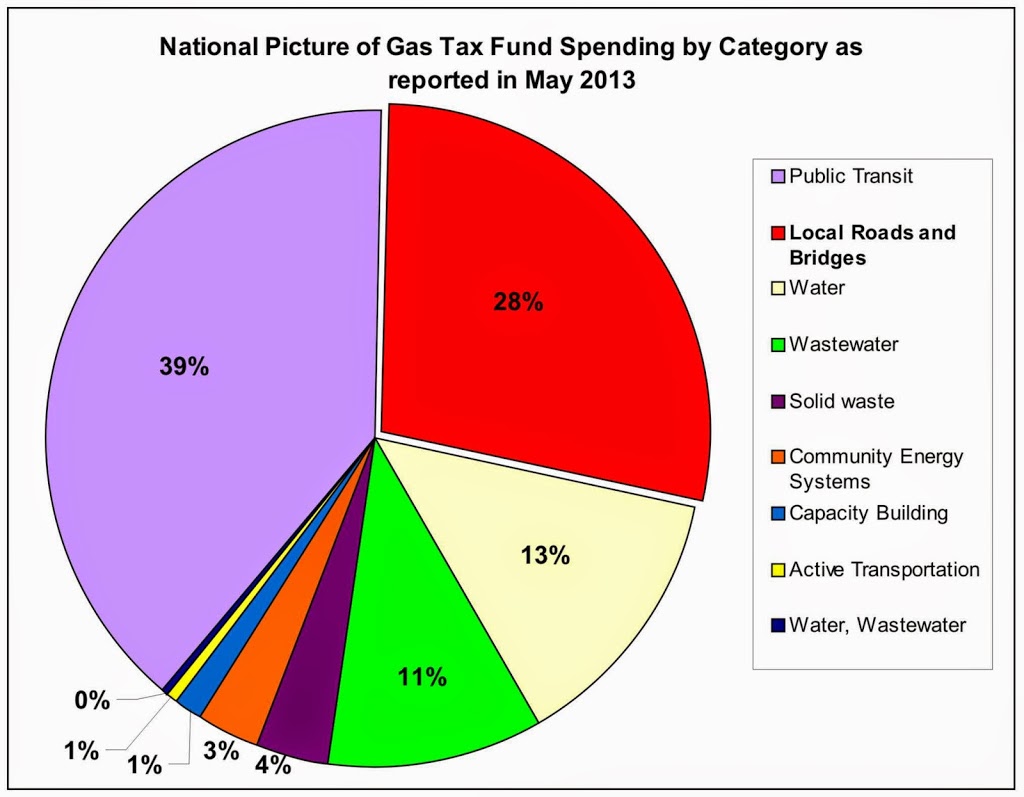

The Federal excise tax goes into the Consolidated Revenue Fund – it all gets stuck in a big pile and mixed infinitely with all the other money the federal government collects, from the 16% duties on Ecuadorian wool socks to the income tax that came off your last paycheque. However, the Feds do pull $2 Billion a year out of that fund, (misleadingly) call it the “Gas Tax Fund” and transfer that directly to municipalities through a slightly convoluted allocation formula. Considering about 40 billion litres of gasoline are sold in Canada every year (not including diesel – which has an excise tax of $0.04/L on sales of 17 Billion litres annually), somewhat less than half of the Federal excise on gasoline is reinvested into this infrastructure fund (which makes the name misleading). Of that less-than-50% approximately 28% is spent on local roads and bridges.

So crunching the numbers, the $146.50 of federal “gas tax” spent by the average person, about $20 goes towards roads.

The Carbon Tax is much simpler to work out. Exactly 0% of it goes to roads. The Province has been quick to point out and reinforce that the carbon tax is “revenue neutral” – it only goes to offsetting income and corporate taxes, and to providing a $200 cheque to rural British Columbians who own a house. All that just to kill a few jobs.

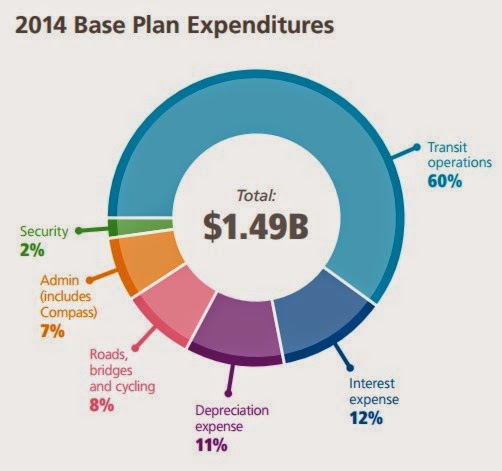

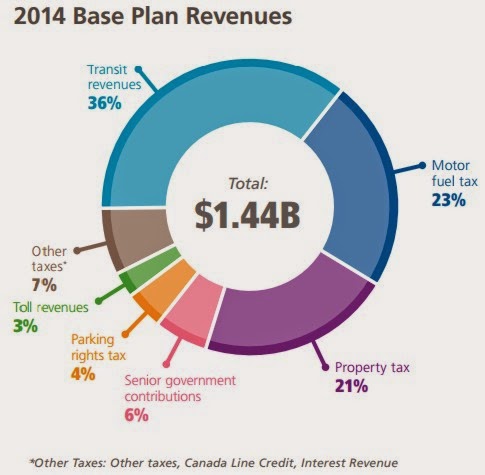

The “Transit Tax” is the TransLink gas levy, and some portion of that does directly go to maintaining roads and bridges. Looking at the TransLink Base Plan for 2014, we can see that TransLink collects $331 Million per year on its gas tax (on about 2 Billion litres of fuels sold in the TransLink area annually), which is 23% of its total revenue. Of this total revenue, about $119 Million (or about 8%) is spent on Roads, Bridges, and Cycling. So just as the federal money goes in to one big consolidated fund from which road money is drawn, the money TransLink gets is pooled and re-distributed (otherwise, their road spending would be decreasing as the gas tax revenues decrease, and that is not happening).

So of the $249.05 of Transit Tax, about $19.92 goes to the roads your drive that car upon.

The Provincial tax is much harder to estimate, as it all also goes to General Revenue, as does the GST hit, of which even a smaller proportion is transferred to the Province for roads spending. So let’s ignore the usual whinging about deadbeat have-not provinces and assume 100% of the GST comes back to the Province, and is pooled with the PST. How much does the Province spend on Roads? According to their recent financial plan, the annual Ministry of Transportation budget is about $800 Million, and a further $1.3 Billion on Infrastructure investment for transportation, meaning $2.1 Billion is spent on transportation. Of course that includes roads and bridges, along with cycling, transit, rail, Ferries (coastal and interior), gondolas, and the Mountain Pine Beetle Strategy (!?). This sounds like a lot, but it is only 4.7% of BC’s annual revenue. Given these very, very generous estimates, something like $10 of the average PST/GST cost of the annual gasoline bill goes to transportation.

That’s it: $50. That is the “toll” the average British Columbian pays every year for using the roads through gas taxes. Notably, this amounts to a “road tax” equal to one half of 1% of the annual cost of owning and operating a car.

There are, of course, major flaws with the above analysis, but none of them change the underlying premise.

First, most of the roads you use every day are paid for and maintained by your municipality, whose revenue sources do not include gas taxes (excepting the transfers from TransLink for the Major Road Network, and a portion of that Gas Tax Fund infrastructure money).

Thirdly, this analysis assumes that people who don’t buy gas do not pay even more for roads and bridges through their other expenditures. A daily driver gives $249 a year to TransLink in gas tax, but a daily 2-zone Transit Pass user gives $1,488 to TransLink in the same year. A daily SkyTrain user pays 6 times as much towards TransLink’s roads budget than someone who drives their car on a road every day. Of course, they both use the roads, just like pedestrians and cyclists and squirrels (who get off comparatively Scot free), but only the transit riders uses the Skytrain. Except that being on the SkyTrain gets her out of the way, “freeing up traffic”, which benefits the road driver.

The big exception is that people who don’t spend $1,831 a year on gas – or $7,000+ a year on a depreciating piece metal – don’t usually stick that extra money in the mattress. They usually spend it on other things. Like bicycle parts, or shoes, or peanut butter sandwiches (which is pedestrian fuel) or iPhone apps or pez dispensers or lottery tickets, beer and popcorn. Every dollar not spent on gas is likely spent in other ways, and when spending on things (be they car things or non-car things) they provide revenue in the form of sales taxes and in income taxes of the people who are selling stuff. That is the nature of our economy. Through the magic of “General Revenue”, just as much of those taxes go to funding roads and bridges as the sales taxes on gasoline does. In this sense, the more you use the roads, the less you likely pay for your share of their use.

As a bonus, that money is most likely not spent on things that destroy the atmosphere, as few things in our society have the same atmosphere-destroying capability on a dollar-by-dollar basis, than 1,400 Litres of gasoline.

So I agree with this. I think the economics has always supported “anything but cars” with respect to cost effective ways to transport goods and people. I remember my father in the 1960s and 70s being appalled at the de-emphasizing of rail in favour of building more and more 6 lane highways for transport trucks to move goods across Southern Ontario. He was CEO of WCI which made large appliances like refrigerators, stoves, washers and dryers. Today, those goods are being transported by truck; not rail. He was only thinking cost efficiency but from today’s perspective – rails have a lower carbon footprint too.

Here’s the rub – 50 years of infrastructure development has favoured roads instead of public transit or rail. Hard to go back. So where’s the prudent path forward? Bikes only have limited use for people transport.

Thanks for the run-down on this Patrick. I’ve been commuting by bike on and off since the late 80’s and have been having this same discussion about where the $ for roads come from. I suspect that back in the 80’s that the arguement that Gas Taxes were being reinvested in the road infrastructure was even weaker, but that over the decades the Federal and Provincial governments have targeted some of that revenue back to infrastructure. It was definitely an eye opener what percentage of transit fees go into road infrastructure.

Personally I don’t get the animosity from motorists – if I had to or chose to drive my car daily I would be ecstatic that thousands of my fellow citizens chose to cram themselves into tin cans to get to work thereby freeing up more road capacity for me.

This seems to contradict your opinions:

https://www.conferenceboard.ca/press/newsrelease/13-10-17/Majority_of_Ontario_Road_Infrastructure_Costs_Paid_by_Motorists.aspx?AspxAutoDetectCookieSupport=1

“The research was initiated and financially supported by the Canadian Automobile Association…”

Are they trying to say that the amount collected by these taxes is similar to the amount spent on roads, even if the taxes aren’t actually spent on roads?

Great read. Too bad the people who make this argument don’t know how to.