We got a lot of work done at Council on Monday night, with a fairly long agenda, starting with an increasingly unusual Public Hearing:

Heritage Revitalization Agreement Bylaw No. 8425, 2024 and Heritage Designation Bylaw No. 8435, 2024 for 203 Pembina Street

It’s been a while since we have had Public Hearing, as we have adopted the now-mandated practice that rezoning applications that fully comply with the Official Community Plan don’t require public hearings. Heritage Revitalization Agreements, however, still require them, so here we are.

HRAs are functionally very similar to rezoning, except in rezoning the City gives a landowner some “value” by allowing them to build more or differently on a lot that the zoning bylaw allows, and in exchange, they provide some “value” to the city, in contributing to amenities or making a contribution to our amenity reserve funds. In an HRA, at least part of the “value” given to the city is the preservation of a heritage asset through permanent Heritage Designation. Usually, that is a heritage building, though it can be a landscape, a fence, or in this case, a Heritage Tree. This is a first for New West.

The project is a small 6-unit townhouse development that fits in the neighbourhood in Queensborough. The challenge with the specimen Red Oak tree is that it is located within the “building envelope” already permitted on the site, so the Tree Protection Bylaw would permit its removal. SO the proponent and staff worked on the HRA pathway to allow development of the land in a way that protects the tree, as it is felt to have acquired cultural importance in the community as a landmark and gathering space. The requirements to care for the tree will be baked into a Heritage Designation Bylaw tied to the property.

The Community Heritage Commission did not support using an HRA in this case, but did hope the City could apply a different tool to protect the tree, but the Land Use Planning Committee chose the HRA route. Other than the tree, the proposal aligns with the RT-3 zoning used for townhouse developments of this type in Queensborough, except for a couple of setbacks adjusted to give the tree more room. Public consultation we generally positive.

We had two written submissions to the Public Hearing and the proponent delegated in favour of the project. We also had 5 delegates speak (multiple times each) against the application. I would characterize their feedback as not opposing the development (none lived near the project) or the tree preservation (they all favoured it), but not liking the tool of the HRA being used this way, for non-specific reasons.

In the end, the majority of Council voted to support the application and designation.

The regular meeting Agenda began with the following items Moved on Consent:

Development Cost Charge Bylaw – Inflationary Amendment

We collect Development Cost Charges from new developments to pay for infrastructure costs related to growth. The amounts are based on a budgeted cost to build the specific infrastructure. Since the cost to build that infrastructure goes up every year, we can do inflationary changes to the DCC rates to help pay for part of this inflationary increase, but need to do so through Bylaw to keep things transparent.

Unfortunately, the provincial DCC regulation requires that we use CPI to calculate this inflation increase, and the CPI “basket of goods” does not reflect the massive inflation in concrete, steel, wood, and construction services which are the things the City buys with DCC money. This is one of the unwieldy aspects of the DCC process that comes along with the transparency and predictability benefits the DCC process provides. Everything in government is a compromise.

Then the rest of the items were Removed from Consent for discussion:

12 K de K Court Esplanade Boulevard Trees

Trees are interesting things. They add to the value of property, the quality of life, climate resilience, air quality, and social cohesion. To some they are the view, to others they block a view. A set of trees planted in City lands along the Quayside 15 years ago are reaching maturity, and some adjacent property owners feel they are too large, block their views of the river and light penetration to their homes. The City has been doing extra maintenance to reduce negative impacts, but some residents want them removed. The city is not in the practice of removing City trees, as it does not align with our Urban Forest Management Strategy, or our climate and livability goals. Staff have been working with the owners to address ongoing concerns, and are drafting a Letter or Understanding letter that outlines the city’s commitment to tree maintenance of the three trees of concern.

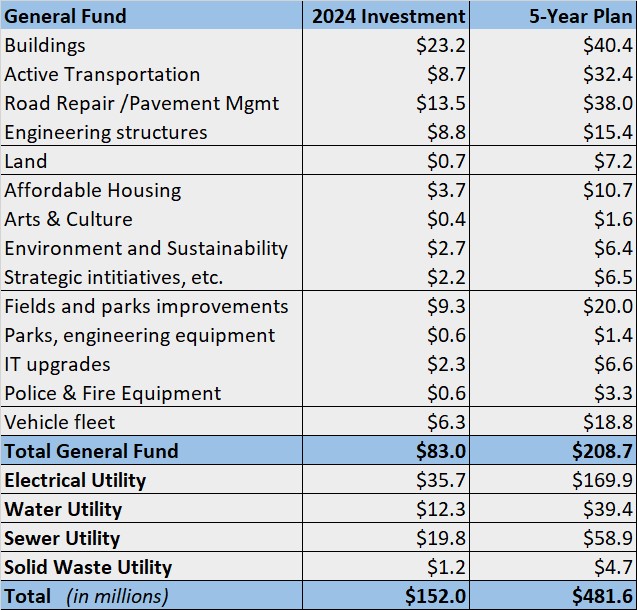

Budget 2024: 2024 – 2028 Five-Year Financial Plan Bylaw

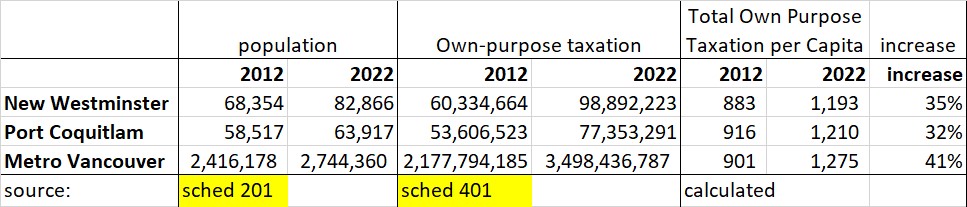

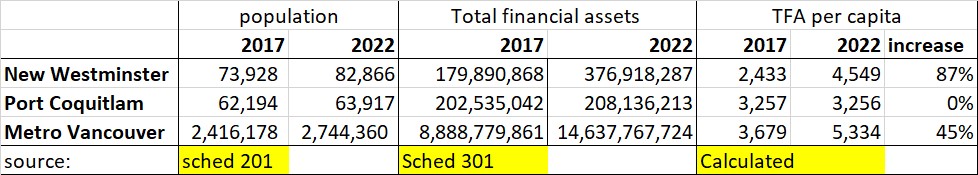

These are the Bylaws representing the 5-Year Financial Plan worked out through numerous Council workshops and meetings. If you have been following along, there is not a lot of news here, but I will write a follow-up post or two with some of the details of the annual budget. This also includes some public feedback received on the budget, including a request for us to spend more on Bus Priority Measures (we boosted this in 2024, but the writer would like to see MOAR!), some concern that the 7.7% increase was high relative to inflation and Port Coquitlam, and some surprisingly details questions about how we account for the delay of hiring new staff. Once again, the Budget was approved for Three Readings.

Grant Program Refinements

New Westminster has one of the most generous Community Grant programs of any City in the Lower Mainland, with almost $1 million in grants awarded every year to community social development, arts, sports, economic development, environmental and cultural programs. This aligns with Council priorities, so staff are doing a review of the process to make it work more efficiently and serve the community better.

Since I have been on Council, there have already been significant changes to the program. The value handed out has gone up a lot (form $700k in 2015 to $1m now) and we have worked to remove Council from review and approval process to make it more community-centered and improve transparency, while giving more power to the Grant Committee model that includes volunteers from the community. We shifted from 8 streams to 3 portfolios in 2019 to make it easier to manage, but it still takes a considerable amount of staff time to manage.

There is a plan to do a comprehensive review of how this process works, aligned with Council’s Strategic Priority of “Community Belonging and Connecting”, but in the short term, there are some smaller changes being made to address staffing challenges and clunkiness in the existing system. The One-Time Small Grants process has not worked very well, and will need to be revised or rolled into the main grant program. For now, it fails the value-for-money test as it takes a lot of staff time for the small amount it gives out.

As the grant program has evolved over the decades, it’s ad-hoc accounting has become more of a challenge as the values get into the seven figures. More applications arrive every year than value in the budget, and not all of the grants are eventually handed out, as many applicants fail to deliver the idea they asked to grant. So we are undersubscribed, and also underspend, making for a complicated Operational budget impact. A more responsible easy to manage this is to set up a Reserve Fund, so non-allotted money in one year can extend over to the following year, and those carryover funds can help address more applications. There are some complications here, as some of the grant value is in-kind services, but staff are asking to set up a process that is accountable and transparent.

There is more to come here, and there will be some deeper conversation with the community about how to structure major changes if that is where Council goes.

Initiating process for updating the City’s corporate logo

The City replaced its corporate logo in 2008, replacing the Coat of Arms with a gold crown. It’s time for a refresh. The City will engage a professional Graphic Designer, who will lead a two-phase community engagement around this. Look for opportunities to engage soon!

Leave of Absence for Councillor McEvoy

If you follow the news, Councillor McEvoy had a heart attack a couple of weeks ago. He received incredible are at RCH, and is recovering from surgery at home. The best practice in local government is to grant medical leave and keep his seat warm for him until his return. He does have some committee roles that we need to fill in his absence, and we did so.

Rezoning and Housing Agreement: 145-209 East Columbia Street – Bylaws for First, Second and Third Readings

The owners of an empty lot in Sapperton what to build a six-story mixed-use building. It is aligned with the OCP, but requires a rezoning. This would have retail at grade, offices on the second floor, and 99 Purpose Built Rental homes, adding to the vibrancy of Lower Columbia. The 99 PBR homes meet the City’s Family Friendly Housing minimums and will provide active cooling to all units. As part of the “great dentist office debate of 2024”, the owners are concerned they will not be able to lease the ground floor unless some flexibility is offered to allow medial services in come of the units, and staff have hammered out a compromise.

Public consultation on this project was generally neutral to positive, with some concerns raised regarding parking (natch) and impact on traffic (double natch). There were some who felt it was too big for the location (though this being within 400m of a SkyTrain station, the new TOA provincial regulations would actually permit 8 stories). We also received a bit of “it is being built specifically for renters, meaning this project puts the safety and security of our quiet neighborhood in jeopardy” kind of feedback, which seems out of touch with the reality of our housing crisis, and is rather disrespectful to the 45% of the people in New Westminster who are renters. In the end, Council voted to approve three readings of this project.

We then read a bunch of Bylaws, including the following Bylaws for Adoption:

Development Cost Charge Reserve Funds Expenditure Bylaw No 8437, 2024

This Bylaw that allows us to spend ~$3 million from our DCC funds on the projects they were earmarked for was approved by Council.

Zoning Amendment Bylaw (810 Agnes Street) No. 8390, 2023 and Housing Agreement (810 Agnes Street) Bylaw No 8389, 2023

These Bylaws that facilitate development of a 33 storey high-rise tower with 352 Purpose Built Rental homes and a publicly accessible indoor community space and adjacent community park at 824 Agnes Street were approved by Council.

We then went through a raft of Motions from Council.

An information report on a Crime and Safety Townhall Forum hosted by the New West Progressives

Submitted by Councillor Fontaine and Councillor Minhas

Whereas the issue of crime and public safety is of concern to the citizens and business owners of New Westminster; and Whereas Councillors Daniel Fontaine and Paul Minhas hosted a community forum attended by over 120 individuals in November 2023; and

Whereas Councillors Fontaine and Minhas committed to drafting a summary report and submitting it to Council and the Police Board via the Chair;

BE IT RESOLVED THAT Council receive for information a summary report from Councillors Paul Minhas and Daniel Fontaine regarding a crime and safety forum they co-hosted in November 2023.

The motion here was to “receive the report”. There were no actions coming out of it, which made it a bit weird for a Notice of Motion process. But that aside, the report is a bit of a mess. It is perhaps a demonstration how public engagement without a clear direction or plan is useless at the reporting out stage. I have no doubt people at the event had valuable input and suggestions, but what is reported out here is a series of strangely unanswered questions, quotes pulled from a newspaper story, and unattributed statements that follow no real theme and draw no conclusions. As a result, no clear recommendations can come out of this, excepting the few things in the summary that read like suggestion to do the things we are already doing.

NOTE: the rest of these Motions below are resolutions intended to be considered at the Lower Mainland LGA conference in May, this being the formal process through which we collectively advocate to senior governments for changes in policy or funding

Allowing local governments to apply commercial rent controls

Submitted by Councillor Henderson

WHEREAS the Province of British Columbia regulates annual allowable residential rent increases through the Residential Tenancy Regulation, B.C. Reg. 477/2003, to protect lower income renters from housing insecurity; and

WHEREAS there is currently no similar Provincial policy to protect small businesses or community-serving commercial tenants from unsustainable, unpredictable, and increasingly significant rent increases;

BE IT RESOLVED that the Province of British Columbia provide local governments with the legislative authority to enable special economic zones where commercial rent control and demo/renoviction policies could be applied to ensure predictability in commercial lease costs, so local small businesses and community-serving commercial tenants can continue to serve their communities.

There has been quite a bit of discussion in the community lately about ground-based retail and commercial, and what the City can do to protect local small businesses that make our neighbourhoods more lively. There have been a few stories recently of businesses facing 200% or 300% lease increases, and deciding it is just not viable to run a small business in the face of that. Though commercial leases are different that residential rent, the impact is the same – if a landlord was able to triple your rent overnight, there would be no such thing as secure affordable housing in our community. One important difference is that small businesses often invest hundreds of thousands of dollars in building improvements to make their business fit in a space, which makes it hard to walk away when the lease changes, and creates too much risk with onerous demolition clauses.

We can complain about 7.7% tax increases (which landlords directly download to leasing businesses), but that pales in comparison to 300% lease increases. The first is hundreds of dollars, the second is tens of thousands. We need to find a way to level the playing field between the people who own the commercial buildings and those who want to set up small community-serving businesses.

I’m not sure how the Lower Mainland LGA is going to respond to this, and there are certainly many details to work out on how rent protections would be applied in the commercial market, but we are asking the Province to consider giving Local Governments the authority to explore these ideas within identified areas of the City which has specific economic development goals.

Additional funding for overdose prevention sites across municipalities

Submitted by Councillor Henderson and Councillor Nakagawa

WHEREAS the Province of British Columbia declared a drug toxicity public emergency in 2016, acknowledging the rapid increase in overdose deaths and the need to deploy the necessary harm reduction strategies with urgency to prevent additional deaths; and

WHEREAS over 13,000 people have died of toxic drugs since 2016 in communities across British Columbia, including at least 2,500 people in 2023, about two-thirds of which were from inhalation, yet only about 40% of supervised consumption and overdose prevention sites in British Columbia offer inhalation services;

BE IT RESOLVED that the Province of British Columbia increase funding for Health Authorities to augment existing and to open new supervised consumption and overdose prevention sites, including related inhalation services, across British Columbia and including municipalities which do not currently

offer this service to residents.

Health Outreach Centers with safe, supervised consumption save lives. People who deny this fact are denying the published research of health care professionals. Too many people in British Columbia are dying from the toxic drug supply for us to engage in that kind of denialism. They are not the complete solution, but they save lives and get people connected to other supports including recovery from their addiction. We need these in every community, because every community has people dying of toxic drugs. We also need to fund them adequately so they can provide health outreach and programs to move people beyond addiction. We also need to fund them so that inhalation is available, as this is largely replacing intravenous drug use in the overdose death statistics.

This resolution is asking the Province to increase funding for this important component of addressing the poisoned drug supply crisis.

Eliminating Barriers to Public Home Care Services and Social Supports for Aging in Place and Public Long-Term Care

Submitted by Councillor Campbell

Whereas seniors, families and seniors organizations have been advocating to improve access to public home care services and supports to assist seniors to live at home, in their communities, longer and to delay or prevent premature admissions to public long-term care facilities; and

Whereas finances can become an impediment to access the required home care services such as housekeeping, more frequent bathing and meal preparation necessary to age in place, and community programs that have been designed to try and meet seniors’ needs are unable to fulfil the increasing

demand;

Therefore be it resolved that the Province eliminate financial and accessibility barriers by investing in more public home care services and social supports required to age in place, and by further investing in public long-term care to ensure seniors are well supported in the continuum of care.

For those who read my Newsletter (link here to subscribe!), you know the outgoing BC Seniors Advocate was at Century House last month talking about senior services, and the places in our province where we need to bring more support to seniors. Not just because it is the right thing to do for seniors, but because investment in seniors home care save the health care system money, and investments in public residential care save seniors money while providing a higher level of care than for-profit homes do. This is advocacy the folks at Century House asked Council to do, and Council voted to support it.

Creating a Ministry of Hospitality

Submitted by Councillor Campbell

Whereas British Columbia is home to over 15,000 restaurants and foodservice vendors that employ over 185,000 workers across the province, generate $18 billion in annual sales and play a key role in supporting BC workers, families, and vital industries such as agriculture, transportation, and tourism and

are at the heart of every community in this province; and

Whereas the costs of food, supplies and transportation have substantially increased, commercial property owners are passing commercial property taxes on to restaurant and food service tenants, many of whom continue to experience longterm impacts from the COVID-19 pandemic;

Therefore be it resolved the Province create a Ministry of Hospitality to support and engage restaurants, food service vendors and the hospitality sector generally by acting as advocates within government for policy development and reform.

This idea is a bit out of left field, but comes directly from the same advocacy efforts that informed the approach to commercial lease rates control proposed above, the “Save BC Restaurants” campaign led by the BC Restaurant & Foodservices Association and Restaurants Canada. Our Local Chamber of Commerce also supported this. The combines voices of hundreds of New West businesses, thousands of BC restaurants, and tens of thousands of food service business across Canada. Let’s hope the Lower Mainland LGA also hears this call.

E-Comm Governance Review

Submitted by Mayor Johnstone

Whereas E-Comm has struggled to provide service levels that meet established standards or the expectations of the communities they serve, while the cost of E-Comm is increasing at an unsustainable rate, creating budget uncertainty for local Police and Fire services, and

Whereas the imminent introduction of next-Gen 911 will represent the single largest change in emergency communications delivery since the introduction of 911, with uncertain cost and operational impacts,

Therefore be it resolved the Provincial Government engage local governments in a comprehensive review of the governance structure and delivery model of 911 emergency call taking, related non-emergency call taking, and emergency dispatch services across BC with a goal to assure reliable, affordable, and sustainable services for all communities.

This resolution was developed in working with the New Westminster Police Board, who are increasingly frustrated with the lack of value for cost we are getting from EComm, the organization that provides 911 call taking, non-emergency call taking, and/or emergency dispatch services for various municipalities across BC.

I don’t think it is necessary for me to list the challenges with EComm that have been impacting our first responders for the last few years. Exacerbated with challenges in BC Ambulance, worsened during the COVID19 Pandemic, and highlighted during the tragic Heat Dome event of 2021, EComm has been challenged to meet not only the service standards set for their industry, but the service levels expected of the community, for years. New Westminster Police could no longer rely on EComm to provide non-emergency call taking because of the massive number of dropped calls and unacceptable wait times, and have taken the measure of bringing non-emerg calls in house at our own cost. Despite recent improvements, 911 service at the best of times can barely meet industry standards, and there is no evidence that resiliency exists in the system to assure it will operate when even a small a regional disaster strikes. At the same time, costs for our Fire Department and Police related to EComm call taking and dispatch are increasing at an unsustainable rate. Meanwhile, on the horizon is the integration of next-Gen 911 that is already looking technically challenging and massively expensive. Community confidence in EComm being able to address these overlapping challenges in a timely way low.

We am hoping the Lower Mainland LGA will support us in asking for the province to step in and lead a comprehensive review of how emergency communications are managed across the province.

And that was the end of a long meeting, with hundreds of rental housing units approved, a new budget bylaw approved, advocacy on major issues impacting our community, a pretty good Monday all around.

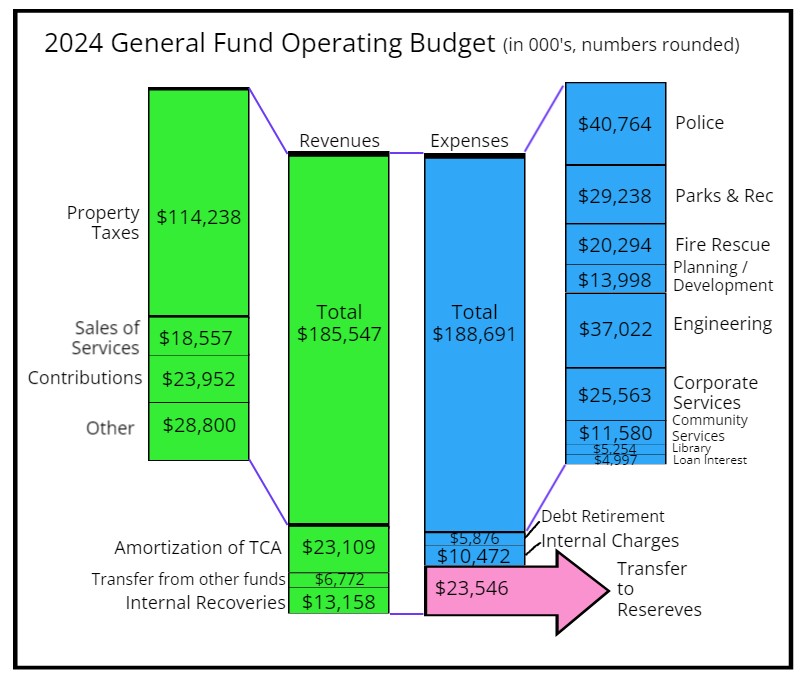

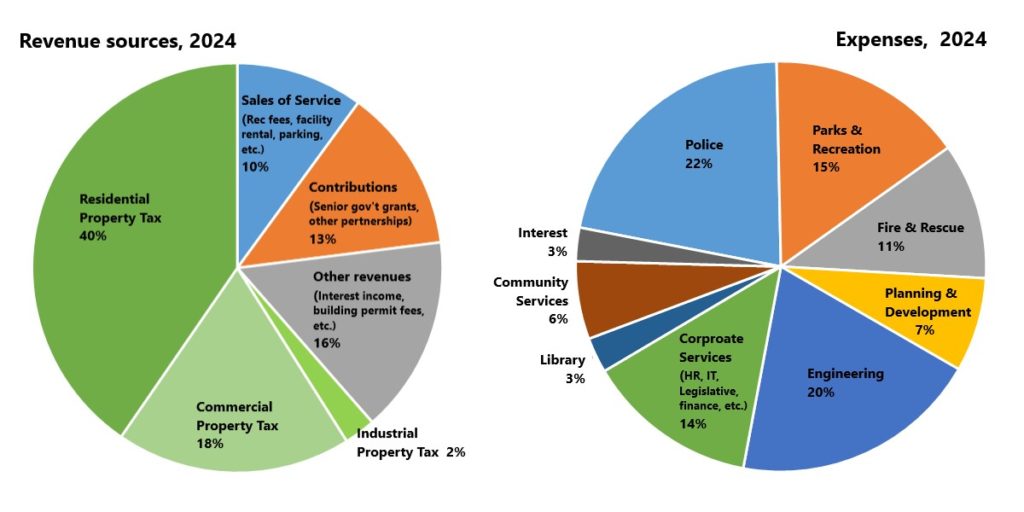

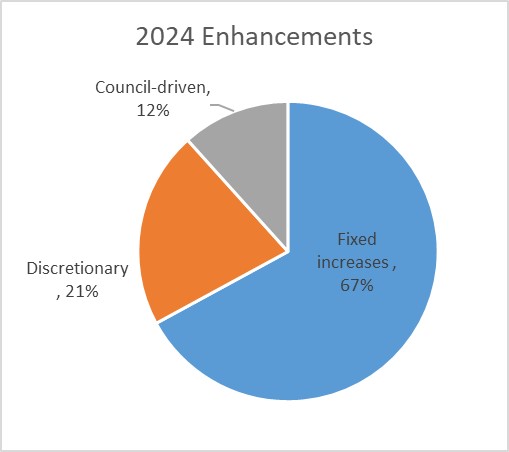

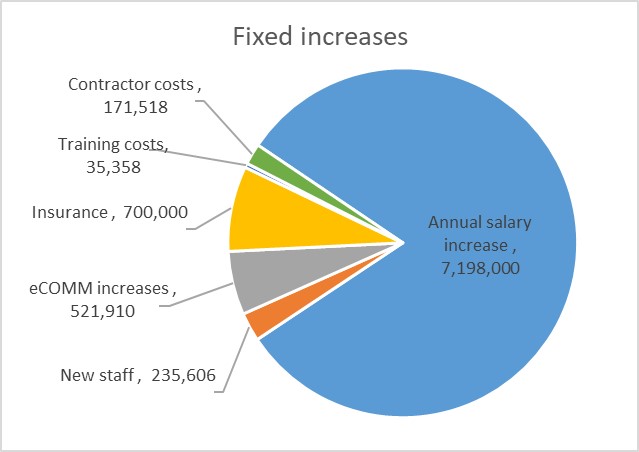

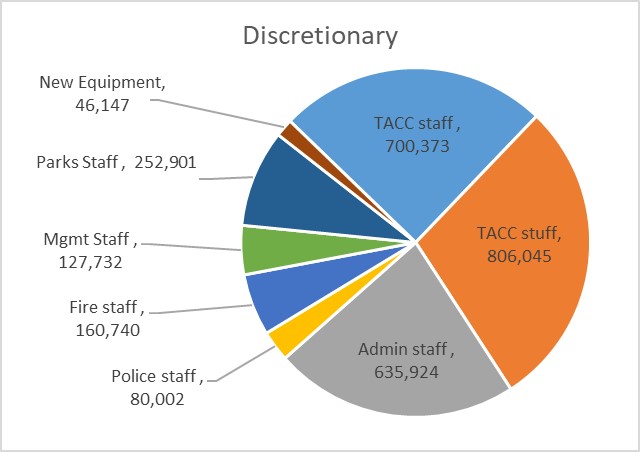

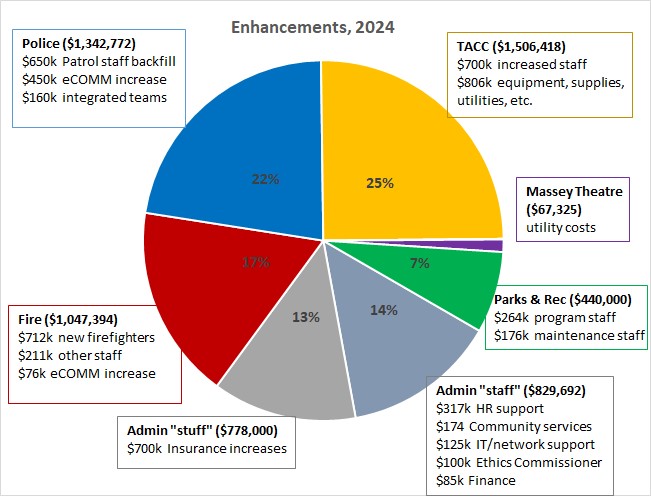

First off, two-thirds of this increase is fixed cost increases, increased costs to deliver the same services we provided in the previous year and things that we are legally or contractually obligated to pay for. About 21% are “discretionary” increases recommended by staff, things we are not legally committed to, but are required to keep service commitments we made to the community. The last 12% are things Council has directed to staff that we want to see happen in the upcoming year. Each of those three can be broken down further:

First off, two-thirds of this increase is fixed cost increases, increased costs to deliver the same services we provided in the previous year and things that we are legally or contractually obligated to pay for. About 21% are “discretionary” increases recommended by staff, things we are not legally committed to, but are required to keep service commitments we made to the community. The last 12% are things Council has directed to staff that we want to see happen in the upcoming year. Each of those three can be broken down further:

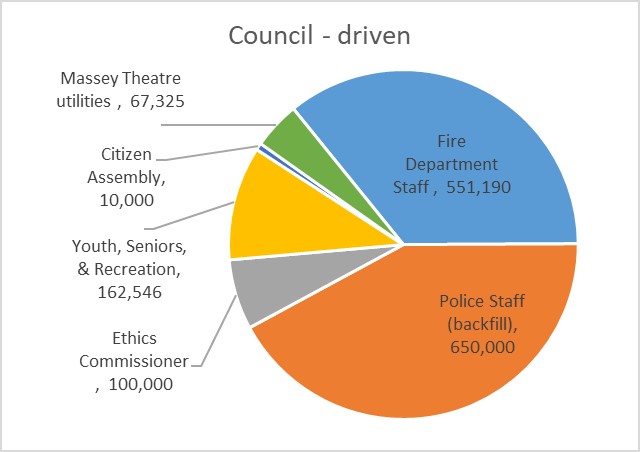

The Council-driven increases are things Council directed to be added to the base budget, mostly in that December workshop. Most of this is in Public Safety, with increased Fire Department staff and new staff for front-line Police to address backfill (that is, we are not increasing the compliment of sworn officers, we are hiring more to provide better coverage for vacancies, sick and parental leave, etc.). Our new Code of Conduct requires budget for an Ethics commissioner, we are augmenting some staff positions to support youth and seniors programming, and the Massey Theatre utility costs are higher than anticipated.

The Council-driven increases are things Council directed to be added to the base budget, mostly in that December workshop. Most of this is in Public Safety, with increased Fire Department staff and new staff for front-line Police to address backfill (that is, we are not increasing the compliment of sworn officers, we are hiring more to provide better coverage for vacancies, sick and parental leave, etc.). Our new Code of Conduct requires budget for an Ethics commissioner, we are augmenting some staff positions to support youth and seniors programming, and the Massey Theatre utility costs are higher than anticipated.

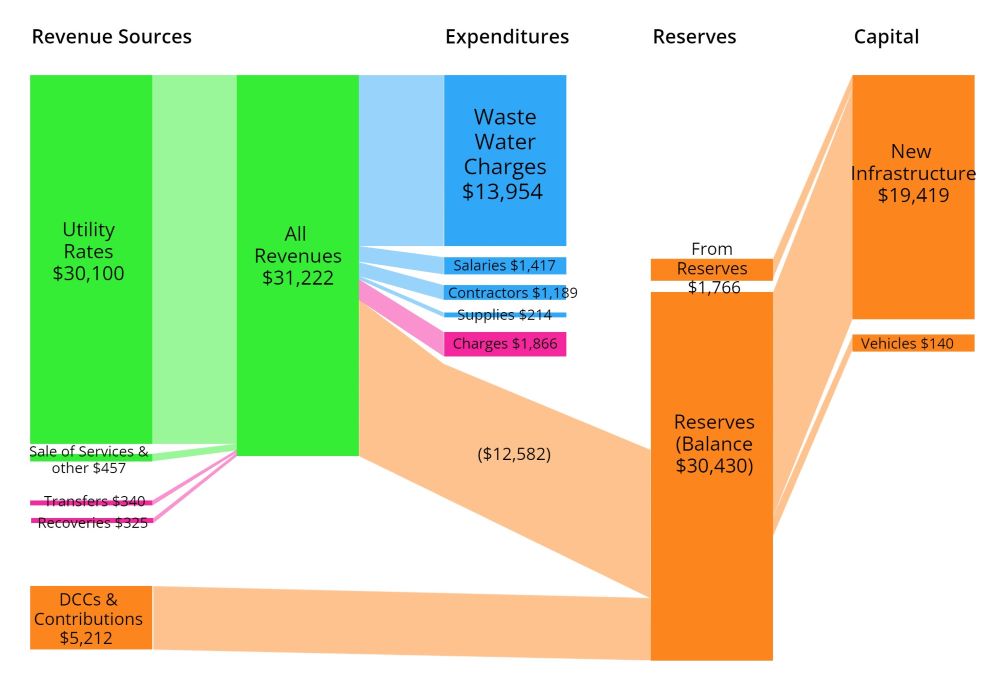

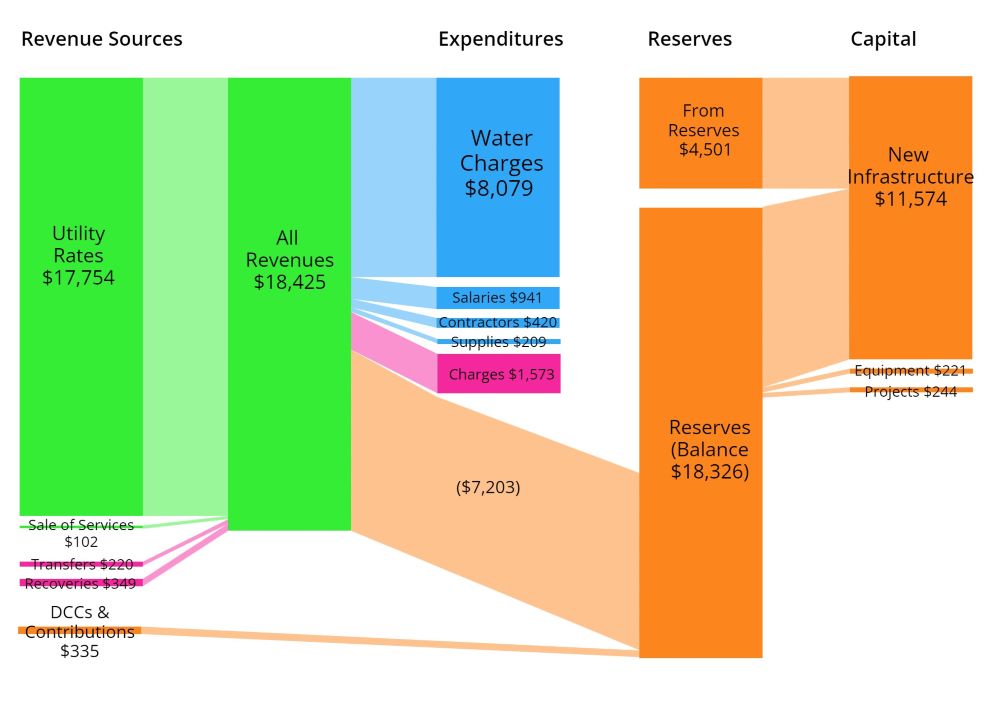

Again, our main source of revenue is utility rates, and the DCC/contribution part is much smaller in water this year. That has mostly to do with the timing of capital projects and our success at getting senior government grants for sewer work more than water work. Of the $18.5 million we take in, about 44% goes directly to Metro Vancouver to pay for the water. We spend less than 10% of our budget on operations, though with internal charges (the money other city departments charge the water utility for services), this cost is a bit higher than in sewers.

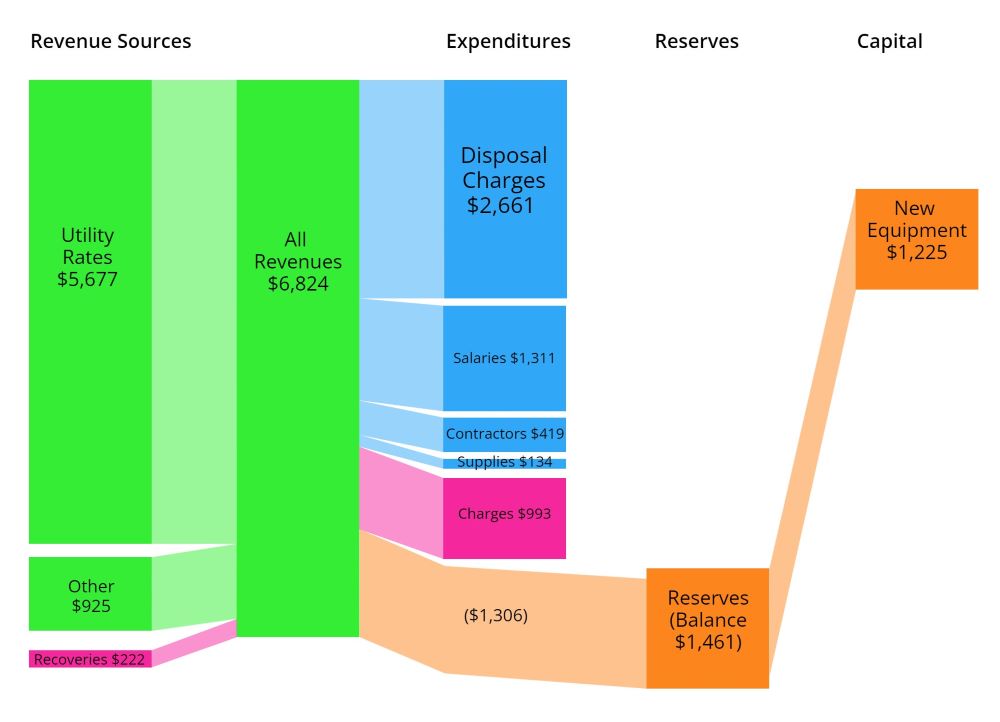

Again, our main source of revenue is utility rates, and the DCC/contribution part is much smaller in water this year. That has mostly to do with the timing of capital projects and our success at getting senior government grants for sewer work more than water work. Of the $18.5 million we take in, about 44% goes directly to Metro Vancouver to pay for the water. We spend less than 10% of our budget on operations, though with internal charges (the money other city departments charge the water utility for services), this cost is a bit higher than in sewers. Garbage and recycling are bit different than the other utilities, as the level of service provided to different parts of the community (house vs. strata, home vs. business, etc.) varies quite a bit, and although disposal charges handed down (mostly from Metro Vancouver) for taking in our waste still eat up almost 40% of all of our revenues, there is a much larger operational cost to solid waste. We need staff to drive those trucks and fuel for the trucks, because you can’t put your trash in a pipeline.

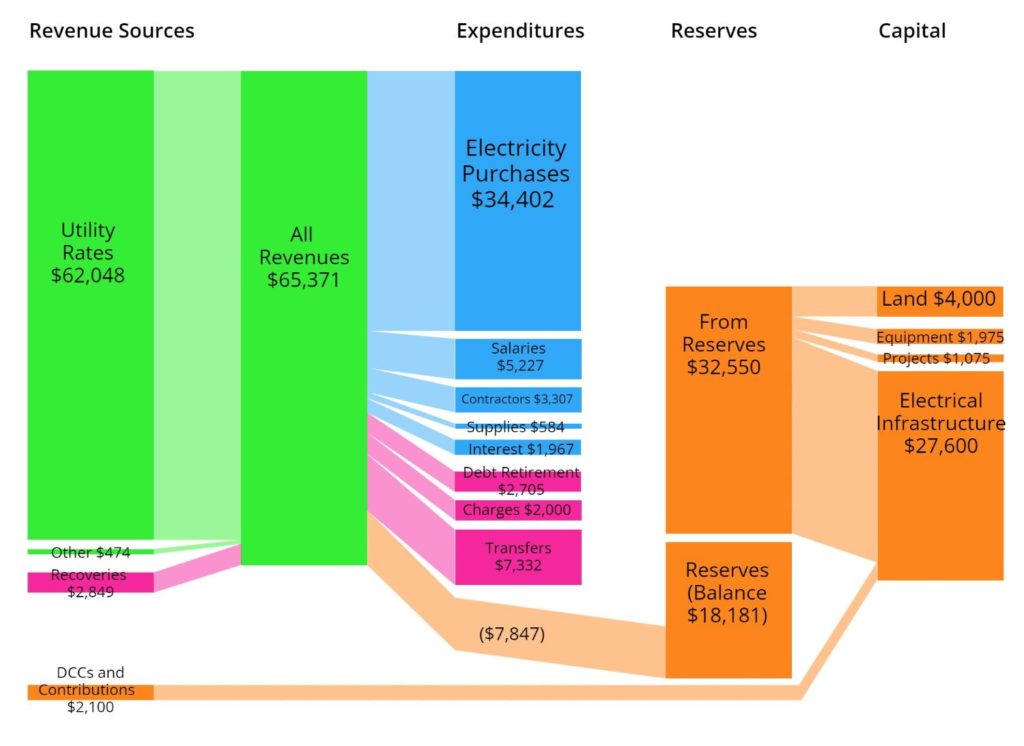

Garbage and recycling are bit different than the other utilities, as the level of service provided to different parts of the community (house vs. strata, home vs. business, etc.) varies quite a bit, and although disposal charges handed down (mostly from Metro Vancouver) for taking in our waste still eat up almost 40% of all of our revenues, there is a much larger operational cost to solid waste. We need staff to drive those trucks and fuel for the trucks, because you can’t put your trash in a pipeline. Our Electrical Utility has a few unique aspects, but it functions like the other utilities we have. The electricity we purchase at wholesale from BC Hydro costs us just over half of our overall revenues, and the cost of day-to-day running of the utility costs about another 17% (or a little over $11 million). This leaves us with about a third of income that goes into our Capital Reserves or directly to the City as transfers. The transfer number here is large because it includes the dividend the City takes every year from electrical utility operational surplus and puts it in the general operational fund. This amounts to about $6 million that the City uses to offset property taxes in providing services that we otherwise wouldn’t be able to deliver.

Our Electrical Utility has a few unique aspects, but it functions like the other utilities we have. The electricity we purchase at wholesale from BC Hydro costs us just over half of our overall revenues, and the cost of day-to-day running of the utility costs about another 17% (or a little over $11 million). This leaves us with about a third of income that goes into our Capital Reserves or directly to the City as transfers. The transfer number here is large because it includes the dividend the City takes every year from electrical utility operational surplus and puts it in the general operational fund. This amounts to about $6 million that the City uses to offset property taxes in providing services that we otherwise wouldn’t be able to deliver.