As a follow-up to my Council report from last week, there were two items I promised to circle back to, like how I circled back to the preposition at the end of that sentence.

English teachers will find that last sentence fun. Hi Mom!

The two items spoke to supporting local businesses and streetscapes. We had a report on Bill 28, and the opportunity for us to explore whether Bill 28-style property tax relief might be a useful tool for our community, and we had a motion from Councillor Nakagawa to review our development and zoning policies to better support local community-serving small businesses. Both of these linked back to some recent chatter in the community around street-level commercial spaces, with people wanting to see more experiential retail and entertainment, and less service and office, to “liven up” the street (I got through all of that without mentioning dentists once). So I want to unpack each item a bit and discuss not just what a city/council can do, but more about the varying ideas about what a city/council should do.

Bill 28 – Property Tax Relief Legislation

I have written quite a bit over the last 9 years about how property tax works (examples here, here, and here). This new legislation changes this a bit for one category of properties, allowing us to provide some short term (5 year) property tax relief for some commercial property owners.

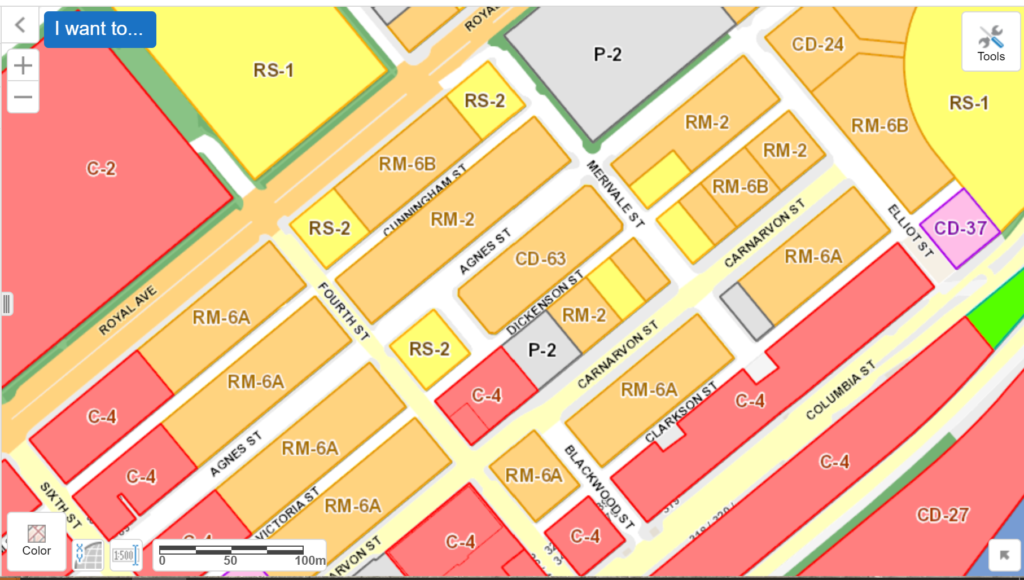

To review, the City sets tax rates, but the tax paid on property is based on BC Assessment Value, determined by “Highest and Best Use” – not necessarily the current value of the property, but the value the property would have if the owner sought to maximize that value. The change with Bill 28 is pretty specific, limited to properties where the “Land-value ratio” greater than 0.95, which means the value of improvements on the land (the existing building) is less than 5% of the total assessed value of the property. Where it is flexible is in how the local government can apply tax relief, and how much.

Some folks would suggest any tax relief for business is good, but we need to be clear this tool provides us a potential tax shift – giving one type of taxpayer some relief transfers that taxation to other taxpayers – not an overall decrease in the revenue on the part of the City. We are taking a more cautious approach here, because not only are there more devils in details, there are likely perverse incentives in there as well.

There is a general feeling that high lease rates and tax rates make it harder from small neighbourhood-serving business to set up shop, and that is surely a factor. The diversity of business types on Twelfth Street is almost certainly a product of low per-foot lease rates. So one part of the thinking here is that if the lease cost (including taxes) was lower, we would more likely get smaller, more diverse, and more interesting business types setting up. Instead of dentists (there, I said it).

One potential challenge with the Bill 28 approach is the recognition that property owners pay taxes, not business owners. Sometimes a business also owns the property they operate out of, but for most small neighbourhood businesses in New West a lease is paid to a landlord. It is the common practice for the landlord to pass the property tax bill directly to the tenant (through “triple net leases”), but there is nothing in Bill 28 or elsewhere that forces a landlord to pass any tax relief savings down to the small business person, so a tax incentive may not get to the small business types we are trying to support, and might actually make the situation worse for the business owner, but better for the Landlord. It may also be a disincentive to upgrading, repair, or improvement of marginal buildings, reducing the attractiveness and safety of commercial spaces.

The City of Vancouver is the only City that has taken on a Bill 28 approach, and we are going to hope to learn from their example as staff bring some data and analysis back to council to see if this approach can be made to help. It may be a useful tool, if we can wield it creatively enough.

Ensuring that ground level retail spaces in new developments prioritize community-supporting businesses and organizations

This motion from Councillor Nakagawa was a bit more all-encompassing, and completely within our jurisdiction. It was asking that the City “review and refresh current policies relating to ground level retail” and “develop policy to ensure that future ground level retail spaces in new development are built to prioritize community-supporting businesses and organizations in alignment with the retail strategy.”

When people ask what Council can do to assure a (insert type of business you want to see) opens in a specific location instead of a (insert type of business you don’t want to see), I often retort with the question: are you sure you want to give me the power to do that? Council has some power to restrict different business types through zoning, but do you really want 7 elected people picking and choosing the businesses in your downtown? Are we the wisest ones to choose this, or is this somewhere we need to ask “the market” to address? Clearly there is a huge spectrum between completely hands-off and being so prescriptive that we end up with streets full of unleased spaces because Council of the day fails to understand the market. Personally, I would love to see a small hardware store downtown. But we had one for a few years, and it was really great, but it was not supported enough to stay open and now you can buy discount shoes in that spot. The reasons for that specific store closing may be complex and global (as they were part of a nation-wide chain that changed its focus and has now closing many Big Box offerings across Canada as well). The City saying “only hardware stores here” would not change those global forces, and we would likely have an empty space in its place, and angry landlord, and a decaying business district. That said, we do exercise limited powers to restrict uses like cannabis or liquor stores (for example) to address perceived or suspected risks.

Nothing against dentists, but mine is Uptown and on the second floor, which is probably a better space for the kind of use that doesn’t really “activate” the street or lead to good walking-around experiences. One thing we can all agree is that a street is more fun to live near and shop on if we have a variety of interesting retail and service experiences along it. As part of our Council Strategic Priority Plan, we talked about supporting a people-centered economy, supporting retail areas that address the needs of the local community.

When Starbucks made a global decision to close thousands of stores including Columbia and 6th, people lamented this loss. Since that time, three new coffee shops have opened downtown, and the old Starbucks location is a popular Italian deli. There are literally dozens of businesses Downtown that were not there at the beginning of the Pandemic, and there is not a lot of lease vacancy. By many measures, the business environment Downtown is pretty healthy. Still, the community is engaged in a conversation about retail mix, though it’s not clear how the community wants to get there.

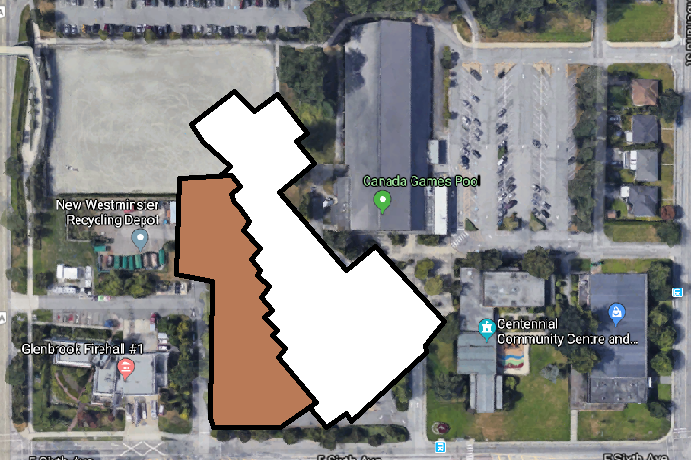

There are two policy areas inherent in this motion we can look at. We can look at how we approve new street-facing spaces in new mixed use developments like 618 Carnarvon, where a brand new dentist office is opening in a space where folks might have wanted to see a coffee shop, or boutique, or other more experiential use. The other is to look at policies that rezone existing spaces to limit the variety of uses possible when businesses turn over, much like we do with liquor stores. To traditional businesses this sounds like a lot of “red tape”, and may result in an incredibly complex zoning bylaw that makes it harder for any business to find the right space. One can imagine this resulting in any new and innovative business types wanting to set up in town having to come to Council to ask permission, because their specific type that doesn’t fit the Bylaw. We went down that path with a video-game arcade that wanted to serve alcohol – and it was a massive pain in the ass for staff, a difficult challenge for the business owner who felt unsupported, and left everyone feeling soured. And that was for a business idea that that everyone on Council liked!

There is a guy I have had lunch with (Hi John!) who suggests the City should simply open more restaurants downtown. I don’t think it is that simple, because I don’t know what the role of the City is in doing that. Restaurants are permitted in almost every business storefont on Columbia Street, there are no rules or regulations preventing them from opening now. At the same time, we cannot force the landlord to kick out the current tenant and put in a restaurant. Reducing taxes of set-up costs will not have any positive effect on a restaurant business model that it doesn’t equally have on a nail salon or dog grooming business model. Further, we are limited by Section 25 of the Community Charter (the part that says it is illegal for a City to “provide a grant, benefit, advantage or other form of assistance to a business”) from directly incenting a specific business owner to do a specific thing. We could, I guess, buy up the land and start leasing it to the business types and business owners we like, but I’m not sure that is the best role of a City government.

All this to say, there is an interesting bit of policy work we can do here, but we are also limited in our powers by legislation and common sense. This also speaks to and augments existing work we are doing around the recently-adopted Retail Strategy.

M

M