As mentioned in last week’s Council Report, I brought a motion asking:

That the NW Electrical Commission include in its ongoing strategic planning and reporting back to Council a pathway to future residential rates that closely match BC Hydro rates while balancing other factors that assure the financial sustainability of the utility.

This was referred to the New Westminster Electrical Utility Commission for consideration, so I thought I would unpack a bit of my motivation for asking for this, with a bit of history of how we got here.

I have been on the Electrical Commission for about 6 years now, and am glad to have seen some significant evolution in how our Utility serves its community. Long appreciated for the reliability of the service and the professionalism of the crews that keep it buzzing, we are now in a time of bigger transition with new leadership and a modified corporate structure. These changes brought the need for the Commission to develop a renewed strategic plan, and they are currently starting that work.

One of the jobs of the Commission is to oversee the budget of the Utility (which is a bit separate from the rest of the City budget) and make a recommendation to Council about rate structures. Over the last 5 years, I would suggest this is somewhere I have sometimes disagreed with some of my Commission colleagues. I am not the Chair of the Commission, but as Mayor I am one of two Council representatives (along with Councillor Minhas) to serve on the commission along with members of the community who have subject matter experience. In my time on the Commission, I have invariably voted along with the consensus on the rate recommendation to Council, because that recommendation has always aligned with the priorities and mandate of the Commission and its existing strategic plan. So this motion is meant to engage the Commission in a discussion about those priorities and mandate and how those relate to rate setting.

As I have written here in the past, our rates need to cover the cost of operating the utility, including planning for significant infrastructure investment, and the utility has always returned a dividend to the City’s general coffers. Recently this dividend has been augmented by Low Carbon Fuel Credits that support the City’s capital planning.

To me, the value proposition of the utility has always been that we pay about the same as BC Hydro rates while we generally get more reliable service and have the ability to integrate other services like BridgeNet and District Energy. The Utility also gives us unique abilities to incentivize and promote community climate action measures like EV charging or air conditioners for low-income households, and allows us to “contract-in” city services like streetlight and traffic light maintenance. On top of this all, the utility still returns revenue to the City budget every year in the form of a dividend that benefits property tax payers. It is clearly a good deal for New Westminster residents and businesses, and makes suggestions that we sell off this valuable and profitable public asset a non-starter.

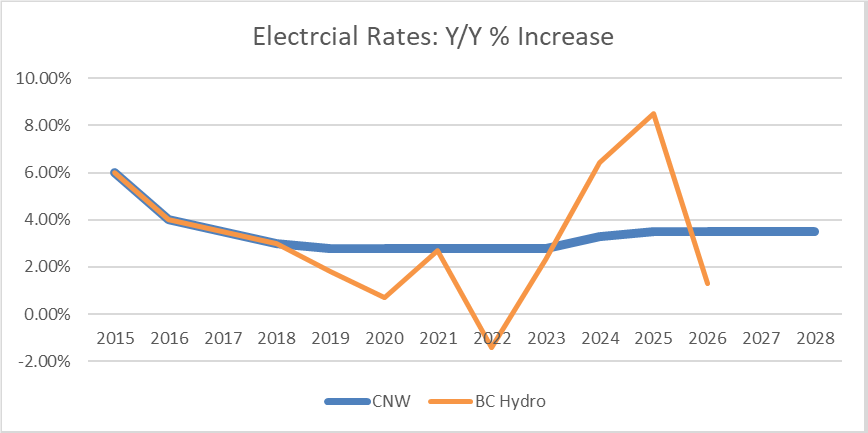

In the last few years, partly because of decisions we made at the Commission, but mostly because of unpredictable shifts in policy by several Provincial Governments and at BC Hydro, we have seen our rates here increasingly decoupled from BC Hydro Rates, with most New West Electrical residential customers paying a bit more than they would to BC Hydro. I am concerned if that trend continues, the value proposition above is eroded.

Council recently approved the recommendation of the Commission for 2025 rates, and in that reporting it was recognized our rates have increased more than Hydro’s over the last couple of years. This is largely because we anticipate upcoming increases in Hydro’s rates to reflect the significant capital investments they are going to need to support in coming years. Our practice has been to bring more rate stability to our customers, smaller increases every year instead of what we see happening at BC Hydro, where flatter rates will inevitably be accented by sudden jumps. The goals have been to buffer against random and unpredictable annual rate shifts, and to assure we have a stable fixed dividend to the city. See this graph from that report in our annual budget deliberations:

In my time on Council, we have never made explicit the goal of coupling our rates with those of BC Hydro, and it was my intent in this motion to ask Council whether this is an instruction we wanted to send to the Commission as they do strategic planning. Council unanimously agreed.

That said, rate setting is complicated, and includes in it a myriad of other policy goals, short and long term. This is part of the reason why we have a Commission to review this specific part of our budget setting. For those reasons, I didn’t think it was appropriate to hamstring the Commission or Council by suggesting our bills should look exactly like a BC Hydro bill. Instead, we sent a message to the Commission that rates largely similar to BC Hydro’s should be one of the principles for future rate setting, and for them to come back with recommendations for how we get there while maintaining the economic sustainability of the Electrical Utility.

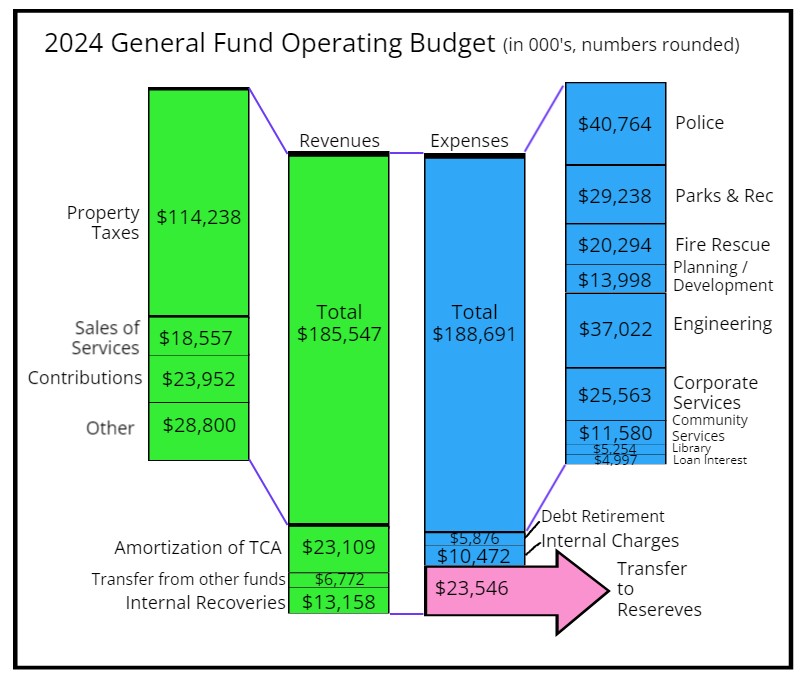

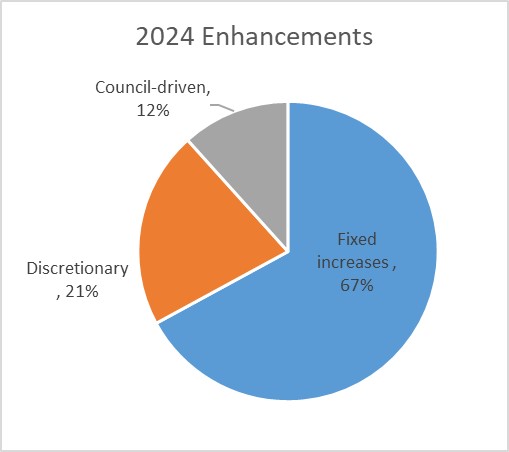

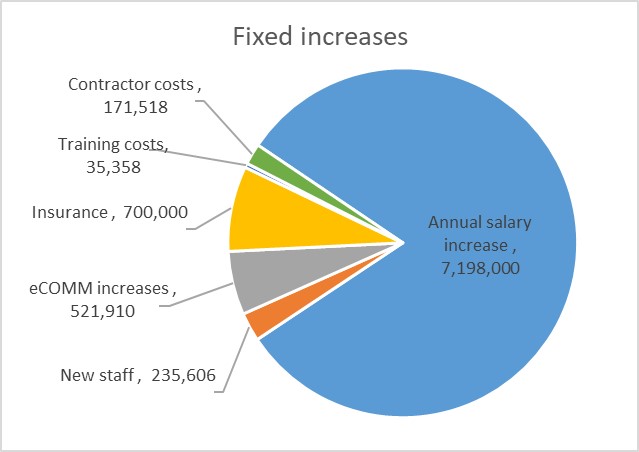

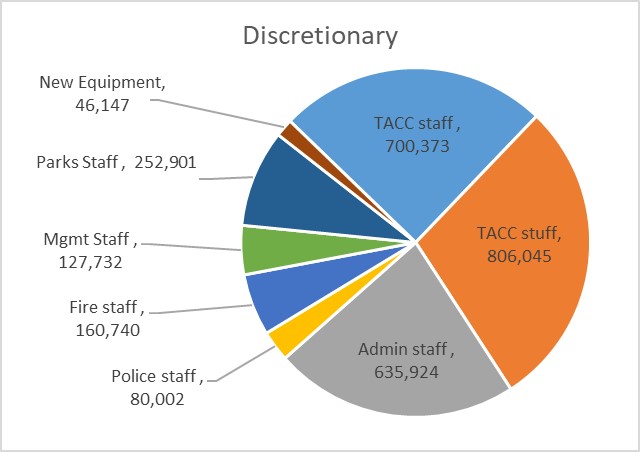

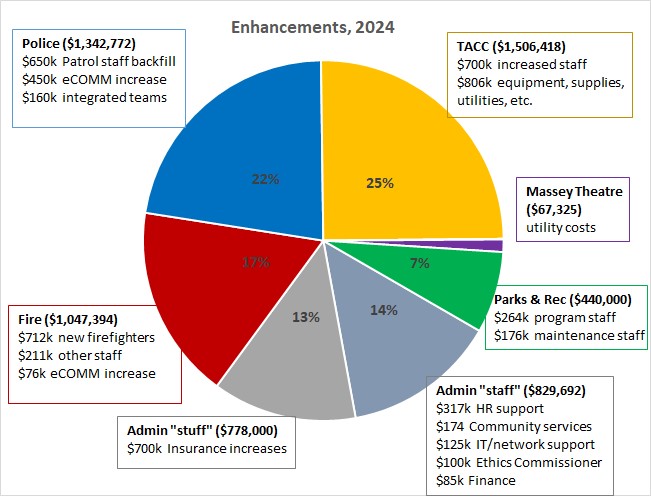

First off, two-thirds of this increase is fixed cost increases, increased costs to deliver the same services we provided in the previous year and things that we are legally or contractually obligated to pay for. About 21% are “discretionary” increases recommended by staff, things we are not legally committed to, but are required to keep service commitments we made to the community. The last 12% are things Council has directed to staff that we want to see happen in the upcoming year. Each of those three can be broken down further:

First off, two-thirds of this increase is fixed cost increases, increased costs to deliver the same services we provided in the previous year and things that we are legally or contractually obligated to pay for. About 21% are “discretionary” increases recommended by staff, things we are not legally committed to, but are required to keep service commitments we made to the community. The last 12% are things Council has directed to staff that we want to see happen in the upcoming year. Each of those three can be broken down further:

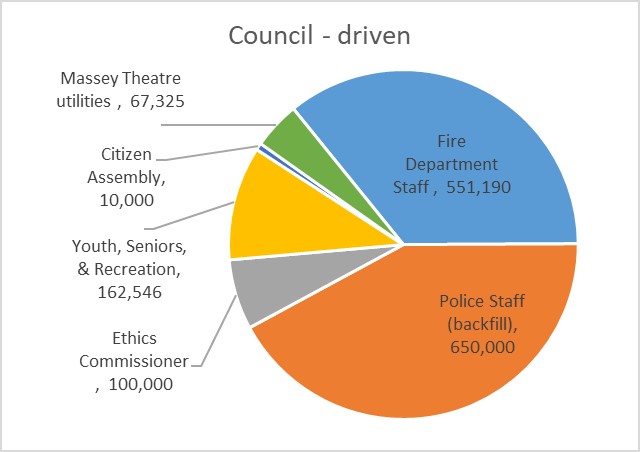

The Council-driven increases are things Council directed to be added to the base budget, mostly in that December workshop. Most of this is in Public Safety, with increased Fire Department staff and new staff for front-line Police to address backfill (that is, we are not increasing the compliment of sworn officers, we are hiring more to provide better coverage for vacancies, sick and parental leave, etc.). Our new Code of Conduct requires budget for an Ethics commissioner, we are augmenting some staff positions to support youth and seniors programming, and the Massey Theatre utility costs are higher than anticipated.

The Council-driven increases are things Council directed to be added to the base budget, mostly in that December workshop. Most of this is in Public Safety, with increased Fire Department staff and new staff for front-line Police to address backfill (that is, we are not increasing the compliment of sworn officers, we are hiring more to provide better coverage for vacancies, sick and parental leave, etc.). Our new Code of Conduct requires budget for an Ethics commissioner, we are augmenting some staff positions to support youth and seniors programming, and the Massey Theatre utility costs are higher than anticipated.

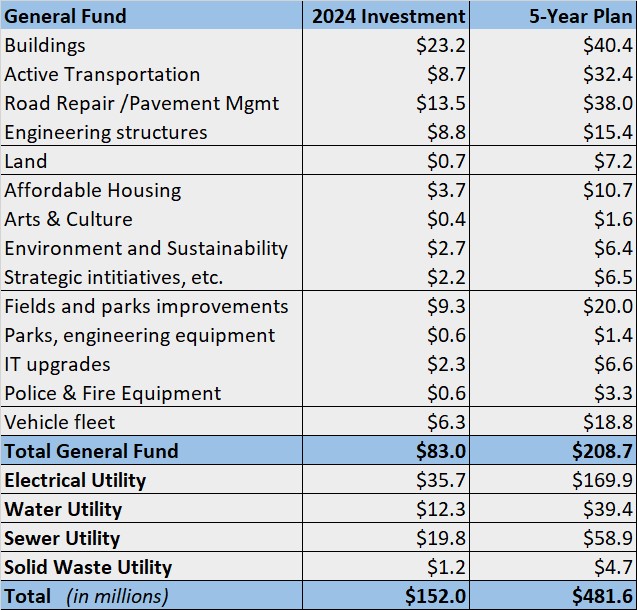

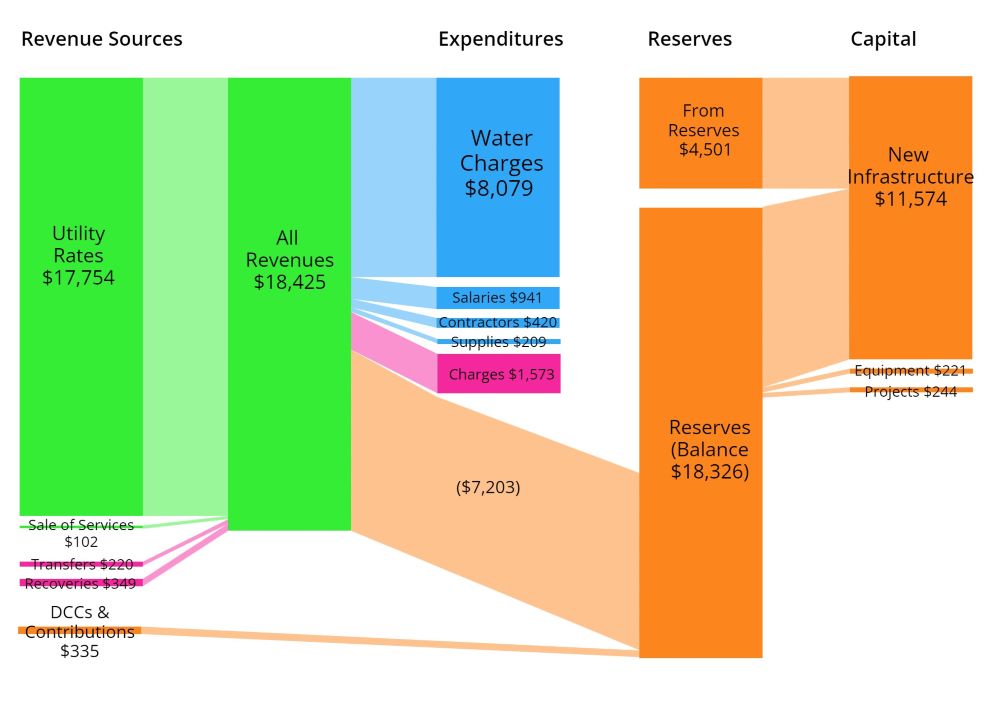

Again, our main source of revenue is utility rates, and the DCC/contribution part is much smaller in water this year. That has mostly to do with the timing of capital projects and our success at getting senior government grants for sewer work more than water work. Of the $18.5 million we take in, about 44% goes directly to Metro Vancouver to pay for the water. We spend less than 10% of our budget on operations, though with internal charges (the money other city departments charge the water utility for services), this cost is a bit higher than in sewers.

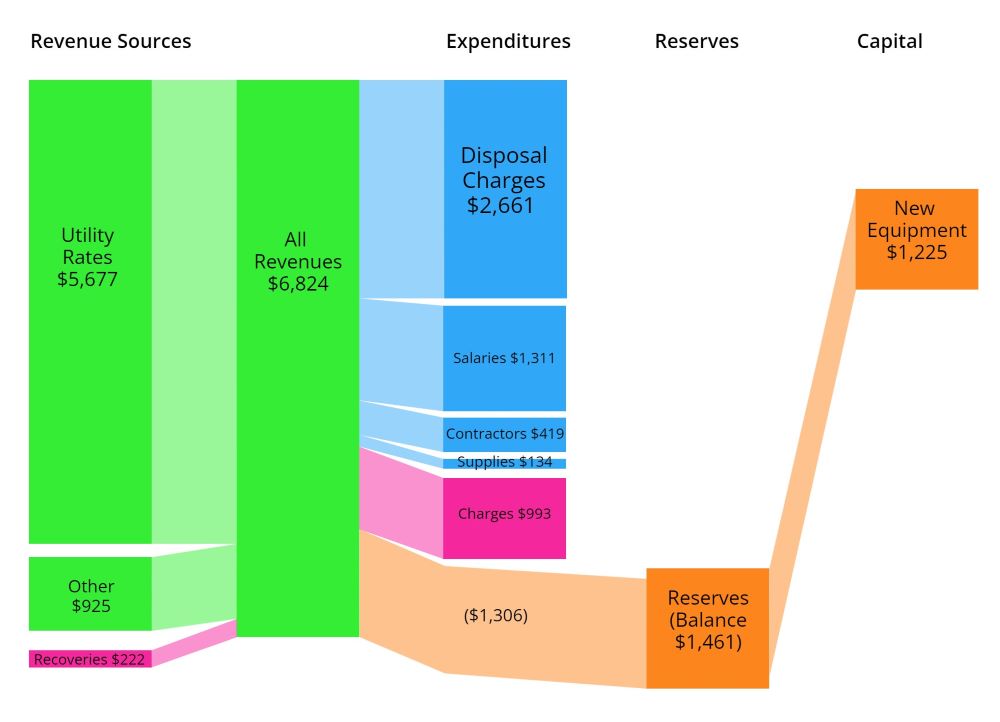

Again, our main source of revenue is utility rates, and the DCC/contribution part is much smaller in water this year. That has mostly to do with the timing of capital projects and our success at getting senior government grants for sewer work more than water work. Of the $18.5 million we take in, about 44% goes directly to Metro Vancouver to pay for the water. We spend less than 10% of our budget on operations, though with internal charges (the money other city departments charge the water utility for services), this cost is a bit higher than in sewers. Garbage and recycling are bit different than the other utilities, as the level of service provided to different parts of the community (house vs. strata, home vs. business, etc.) varies quite a bit, and although disposal charges handed down (mostly from Metro Vancouver) for taking in our waste still eat up almost 40% of all of our revenues, there is a much larger operational cost to solid waste. We need staff to drive those trucks and fuel for the trucks, because you can’t put your trash in a pipeline.

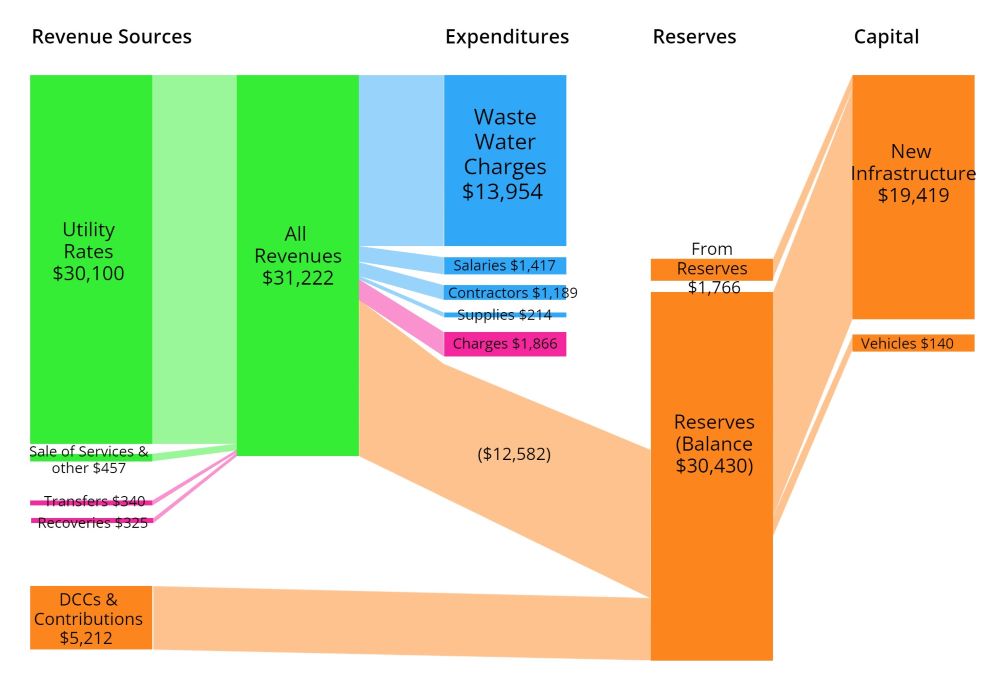

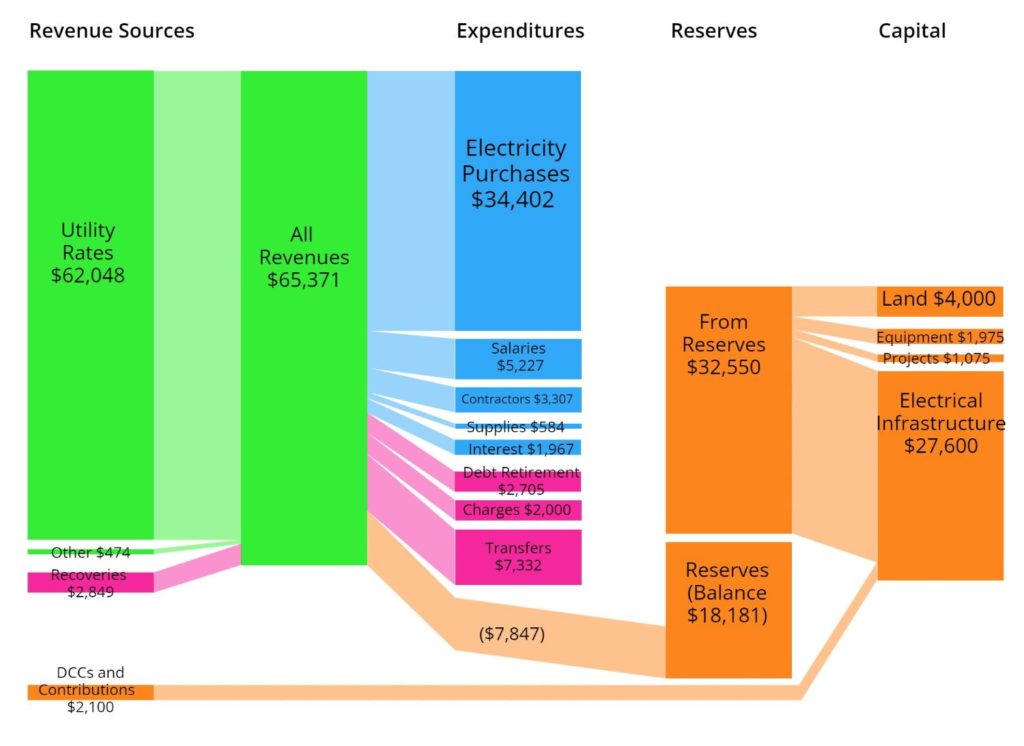

Garbage and recycling are bit different than the other utilities, as the level of service provided to different parts of the community (house vs. strata, home vs. business, etc.) varies quite a bit, and although disposal charges handed down (mostly from Metro Vancouver) for taking in our waste still eat up almost 40% of all of our revenues, there is a much larger operational cost to solid waste. We need staff to drive those trucks and fuel for the trucks, because you can’t put your trash in a pipeline. Our Electrical Utility has a few unique aspects, but it functions like the other utilities we have. The electricity we purchase at wholesale from BC Hydro costs us just over half of our overall revenues, and the cost of day-to-day running of the utility costs about another 17% (or a little over $11 million). This leaves us with about a third of income that goes into our Capital Reserves or directly to the City as transfers. The transfer number here is large because it includes the dividend the City takes every year from electrical utility operational surplus and puts it in the general operational fund. This amounts to about $6 million that the City uses to offset property taxes in providing services that we otherwise wouldn’t be able to deliver.

Our Electrical Utility has a few unique aspects, but it functions like the other utilities we have. The electricity we purchase at wholesale from BC Hydro costs us just over half of our overall revenues, and the cost of day-to-day running of the utility costs about another 17% (or a little over $11 million). This leaves us with about a third of income that goes into our Capital Reserves or directly to the City as transfers. The transfer number here is large because it includes the dividend the City takes every year from electrical utility operational surplus and puts it in the general operational fund. This amounts to about $6 million that the City uses to offset property taxes in providing services that we otherwise wouldn’t be able to deliver.