We had a long meeting this week, but it is a busy time in the City, so nothing to surprising there. We started with a somewhat uncommon thing, the Parcel Tax Roll:

Parcel Tax Roll Review Panel: Confirm and Authenticate Local Area Service Parcel Tax Roll

This is a bit of a ritual we go through with the Business Improvement Areas Bylaw. BIAs are not your regular business organization, they are constituted under Section 215 of the Community Charter, which permits the City to charge building owners in the designated area a special parcel tax (a tax based on the size of the parcel, not on the assessed value), then return that tax revenue to the organization to spend on business-benefitting activities. Because the parcel tax is based on measurement of area or length of street frontage, we need some sort of process to assure those numbers are accurate, and for folks to appeal if they feel they are being over or undercharged (like the service BC Assessment offers for normal property tax). Once we have provided the opportunity to appeal, the Council needs to sign off on the Parcel Tax Roll. We do this every 5 years for each BIA, and this was us closing off that work for the Uptown BIA.

Our Regular agenda was mixed up a bit by moving items around so public delegates who signed up to speak to items were able to prior to us considering them, so I’m going by original agenda order here, not the actual order we did things at. As always, this starts with items Moved on Consent:

Construction Noise Bylaw Exemption Request: 81 Braid Street (Braid Street SkyTrain Station)

They are doing maintenance at the Braid SkyTrain station, parts of which needs to occur when the trains aren’t running, so they need a bylaw exemption to do that work. ELMTOTS don’t believe this.

Riparian Areas Protection Amendment Bylaw No. 8413, 2024

There is a provincial law called the Riparian Areas Protection Regulation. It is meant to protect riparian areas (areas adjacent to fish-bearing streams, like the Brunette River) form encroachment from development. It requires setbacks from streams be incorporated in new development, though older developments from before the 2005 adoption of the RAPR are generally exempt. The language and regulations change over time, and the City is required to update its bylaws to reflect these changes.

The following items were Removed from Consent for discussion:

2024 Tax Rate Bylaw No. 8445, 2024

The City’s budget and 5-year financial plan prepared, we now need to approve a Bylaw that reflects the needed taxation revenue to get that work done. This is procedural, but there is some good data in here about how land values impact taxation. I’ll maybe write a follow-up, but with the 7.7% increase in taxes this year, your residential mill rate (the amount you pay per $1,000 of home value) went from 2.50046 to 2.262767. Yes, it went down 9.5%. This is because property values are increasing at a much faster rate than taxes.

Community Advisory Assembly Terms of Reference and Membership Update

The Community Advisory Assembly has had several meeting, and are already working on their first reports for Council. Their first task was to agree to a Term of Reference (which we are approving here). And as is typical with Community Committees there is a bit of attrition as some members have life circumstances that change and don’t allow them to commit their volunteer time to this kind of thing. We have had three members drop off, but have a quiver of applicants from the first call for volunteers. Staff used the same selection process as used originally to assure we are as closely as practicably matching the demographics of the City, and are providing a proper supportive environment for all volunteers.

4.4 Council Code of Conduct Amendment Bylaw No. 8457, 2024

We have adopted a Code of Conduct, and hiring an Ethics Commissioner is fundamental to making the Code of Conduct operable. He position remains vacant, and this amendment will hopefully allow us to resolve the vacancy.

Zoning Amendment and Housing Agreement (51 Elliot Street) – Bylaws for First, Second and Third Readings

This project has been working through approvals for some time, slightly delayed by COVID, by some extensive revisions since initial application, and work to secure operators for the non-profit part of the project. This is a new 37-storey residential tower on a vacant property downtown. It will include 13 non-market homes to be operated by Metro Vancouver Housing Corporation and a childcare to accommodate both toddler and pre-school ages to be turned over to the City to be operated by a non-profit.

It meets all city requirements regarding parking and active transportation measures, is consistent with our OCP and other city policies including meeting Step 4 in the Zero Carbon Step Code (fully electric), though the number of non-market units is lower than we aspire towards with our Inclusionary Zoning policy. The non-market unit count is lower than ideal, as there was a desire to provide larger (more family-friendly) units and to achieve the deep subsidy level of affordability. Having done the economic analysis here, it’s clear the IZ policy cannot be fully applied at this site and still have a viable project. Metro Vancouver Housing knows the affordable housing market, and backs us up on this assessment. There has been consultation on the project, and many of the residents of the adjacent condo tower (built in 2017) about proximity to the tower, shadows and views. The Design Panel support the project.

In the end, Council supported this project going to Third Reading, and made a further request that staff work to enhance the width and comfort of the public walkway on the north side of the building to make for a better connection to Albert Crescent Park.

Zoning Bylaw Text Amendment: 408 East Columbia Street – Bylaw for Three Readings

This application was previously discussed at Council, now it is time for Council to make a decision, and it speaks directly to my previous post where I wrote about the desire to find balance between office/service and active spaces on our retail streetscapes. The new 6-storey mutli-use building in Sapperton has residential above commercial and office space. The original intent was for 30% office at grade, perhaps with a restaurant, but a tenant has not been found, and a dentist wants to open up moving that office ration to 50%. I don’t want to go over my other post too much, but Council had a good discussion about this. Dentists do actually drive foot traffic, but don’t generate the kind of space “stickiness” that experiential retail does. In the end Council unanimously decide to NOT support this change, perhaps reflecting that the zeitgeist of the times has got ahead of our ability to bring in policy changes. No surprise here.

We then read a bunch of Bylaws, though none were for Adoption, so no need to belabor those readings here. We then moved on to Motions from Council:

2026 FIFA World Cup

Submitted by Mayor Johnstone

Whereas the FIFA World Cup is the most widely viewed and followed single sporting event in the world, and for the first time ever Vancouver will be a host city for seven games in the 2026 event; and

Whereas association football is a truly international sport, with 48 nations from 6 continents participating in the 2026 World Cup, and represents a unique opportunity for a community like New Westminster with its rich diversity of cultures and nations of origin to bring community together and celebrate our diversity through sport and cultural exchange; and

Whereas there are economic and other barriers to direct participation in FIFA events related with the World Cup for many members of the New Westminster community; and

Whereas New Westminster Council has identified Community Connecting and Belonging as a Strategic Priority, including community-building activities that bring the diverse community together for shared events and experiences;

Therefore Be It Resolved that Staff report back to Council with opportunities to activate public spaces across New Westminster, to apply for external funding, and engage local cultural, youth, sports, and business organizations for free and low-barrier public gathering, public viewing, and community celebration to coincide with the 2026 FIFA World Cup.

The World Cup is going to be a big event for the region, and for a City like New Westminster where there is a huge cultural diversity and many first- and second-generation Canadians who still carry a cultural torch for their homelands, it is an exciting time to celebrate and share culture. With all respect to the Olympics, it might be the greatest international multicultural festival on earth. So let’s celebrate.

I intentionally didn’t want to prescribe too much about what we can do here in New West, and I want to start the conversation now, 781 days prior to kick-off, so we can engage our community (such as representatives from the Latina American and African Communities who delegated to Council on this), and give staff the time to plan and budget for an appropriate suite of events. Of course, we also need to engage out BIAs, Chamber, Tourism, and other organizations in the City, to see if and how they want to partner with us. New West is uniquely placed to be a “second hub” of World Cup activity after Downtown Vancouver where the local gems will be held. I want to see us grab this opportunity, and consistent with our Council Strategic Priority Plan, find the opportunity to bring community together in celebration of our diversity and our common spirit of fun.

Council supported this motion.

Improving the public’s access to trees during the City’s biannual tree sale

Submitted by Councillor Fontaine

Whereas the City has a goal of a 27% canopy coverage within New Westminster by 2030; and

Whereas by partnering with residents, the City aims to reach its goal of planting 3,300 trees on private land, and a further 8,500 on public land by 2030; and

Whereas the total trees available for purchase as part of our biannual tree sale regularly falls well short of demand from local residents

BE IT RESOLVED THAT staff be directed to assess whether the Climate Action Reserve Fund decision-making framework can support the purchase of up to an additional 3000 trees over the next three years (2025-2027) to be sold as part of the City’s bi-annual tree sale

The City does two tree sales a year. We buy in bulk and sell at a deeply discounted price of $10. We do this because the our Urban Forest Management Strategy includes an increase of 3,300 trees on private property over 10 years. By selling 300 trees a year for 10 years this solves 90% of our problem, with other strategies (like replacement policies under our Tree Protection bylaw) providing the balance.

Of course, the cost isn’t just buying the trees and selling at a deeply subsidized cost (after all, anyone can go down to the Nursery and buy a tree if they want, we are just giving them a cheaper option). There is also a significant logistics and staffing cost to getting 150 trees together to distribute on the distribution day. I don’t know the total cost of the program but it is tens of thousands of dollars a year.

I actually like that this motion is asking to apply the CARF decision-making framework to determine if increasing the number of trees is an appropriate way to spend CARF money. Council supported this motion.

Then we had two items of New Business

Programs to Serve Isolated Seniors Funded by the United Way British Columbia

This is an announcement (and Council endorsement) of three externally-funded programs to be delivered in the City to support vulnerable and isolate seniors. There are three programs being rolled out – one to coordinate free community meals – three per month in three City facilities in different neighbourhoods, which will not only help with food security, but will also help isolated seniors to build social connections in their community. He second is enhances volunteer coordination staff to improve Century House and Seniors Services Society’s ability to deliver their services in community. The third is a Community Connections coordinator to connect older adults to supports and services through referral. This is all possible though $225,000 in grants from the United Way, and is coordinated by our incredible staff at Century House. External funding leveraged to activate the community on an identified priority topic. This is good news

New Westminster Grant Funding from Bloomberg Philanthropies Youth Climate Action Fund Program

This is another announcement (and Council endorsement) of an externally-funded program to be delivered in the City to support Youth in taking Climate Action. This will provide between $70,000 and $206,000 (depending on program success and need) to activate local youth, provide them resources to engage their community in actions that make a difference, while learning skills and building capacity. New West was selected along with 100 cities across the world who all attended the Local Climate Action Summit to be part of this new program to activate the energy and ideas of youth to move local climate solutions. External funding leveraged to activate the community on an identified priority topic. This is good news

And with all that good news in our back pockets, we called it a night.

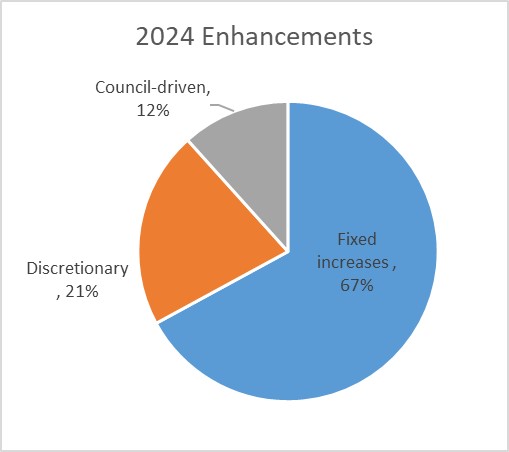

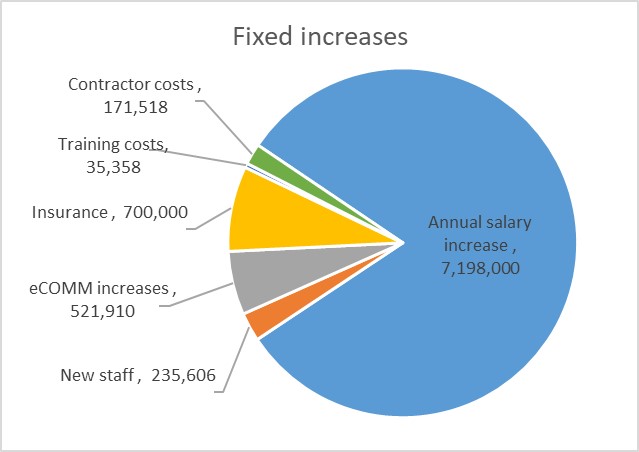

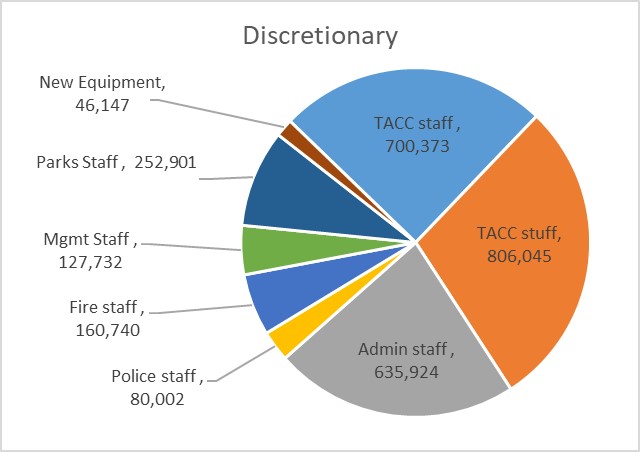

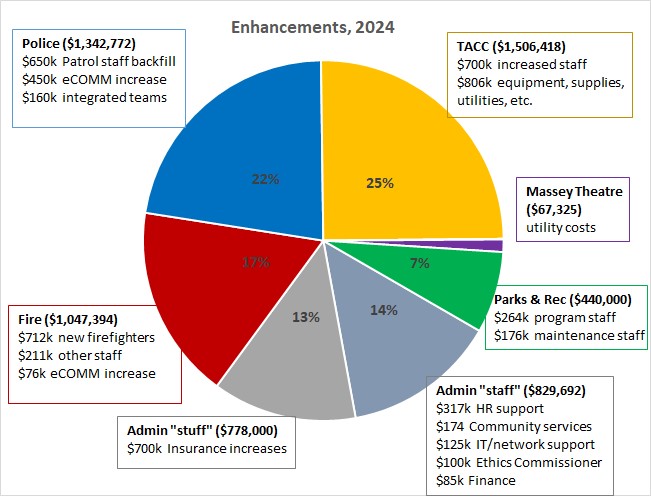

First off, two-thirds of this increase is fixed cost increases, increased costs to deliver the same services we provided in the previous year and things that we are legally or contractually obligated to pay for. About 21% are “discretionary” increases recommended by staff, things we are not legally committed to, but are required to keep service commitments we made to the community. The last 12% are things Council has directed to staff that we want to see happen in the upcoming year. Each of those three can be broken down further:

First off, two-thirds of this increase is fixed cost increases, increased costs to deliver the same services we provided in the previous year and things that we are legally or contractually obligated to pay for. About 21% are “discretionary” increases recommended by staff, things we are not legally committed to, but are required to keep service commitments we made to the community. The last 12% are things Council has directed to staff that we want to see happen in the upcoming year. Each of those three can be broken down further:

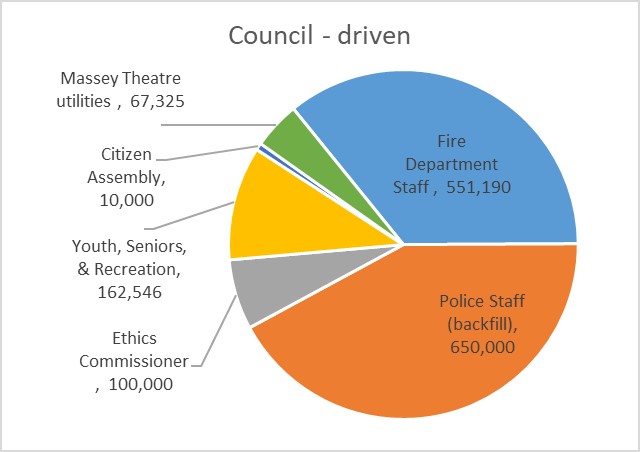

The Council-driven increases are things Council directed to be added to the base budget, mostly in that December workshop. Most of this is in Public Safety, with increased Fire Department staff and new staff for front-line Police to address backfill (that is, we are not increasing the compliment of sworn officers, we are hiring more to provide better coverage for vacancies, sick and parental leave, etc.). Our new Code of Conduct requires budget for an Ethics commissioner, we are augmenting some staff positions to support youth and seniors programming, and the Massey Theatre utility costs are higher than anticipated.

The Council-driven increases are things Council directed to be added to the base budget, mostly in that December workshop. Most of this is in Public Safety, with increased Fire Department staff and new staff for front-line Police to address backfill (that is, we are not increasing the compliment of sworn officers, we are hiring more to provide better coverage for vacancies, sick and parental leave, etc.). Our new Code of Conduct requires budget for an Ethics commissioner, we are augmenting some staff positions to support youth and seniors programming, and the Massey Theatre utility costs are higher than anticipated.

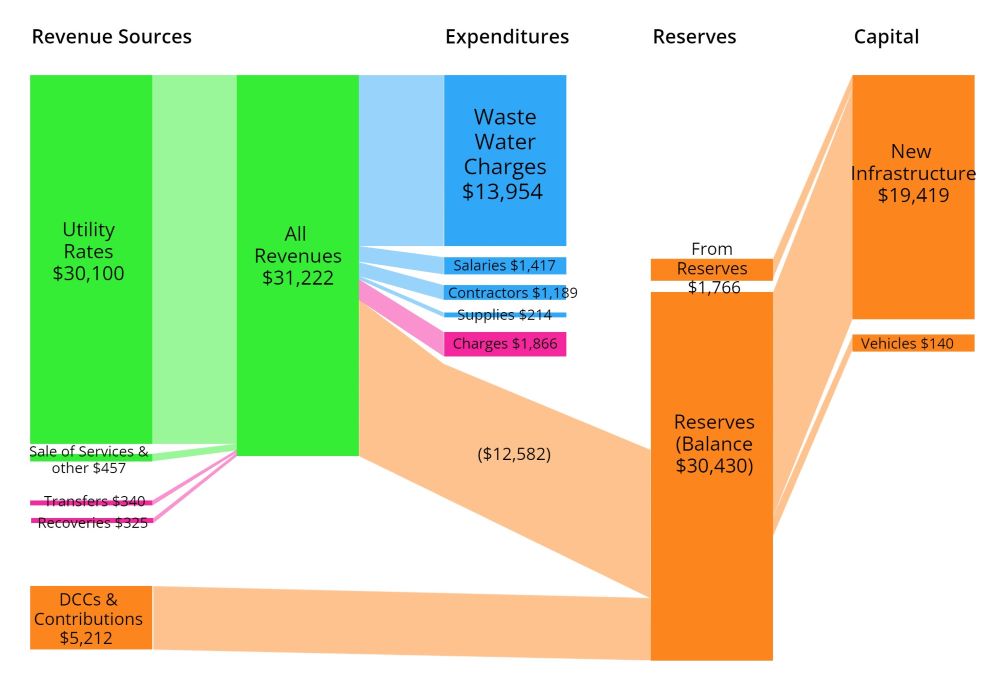

Again, our main source of revenue is utility rates, and the DCC/contribution part is much smaller in water this year. That has mostly to do with the timing of capital projects and our success at getting senior government grants for sewer work more than water work. Of the $18.5 million we take in, about 44% goes directly to Metro Vancouver to pay for the water. We spend less than 10% of our budget on operations, though with internal charges (the money other city departments charge the water utility for services), this cost is a bit higher than in sewers.

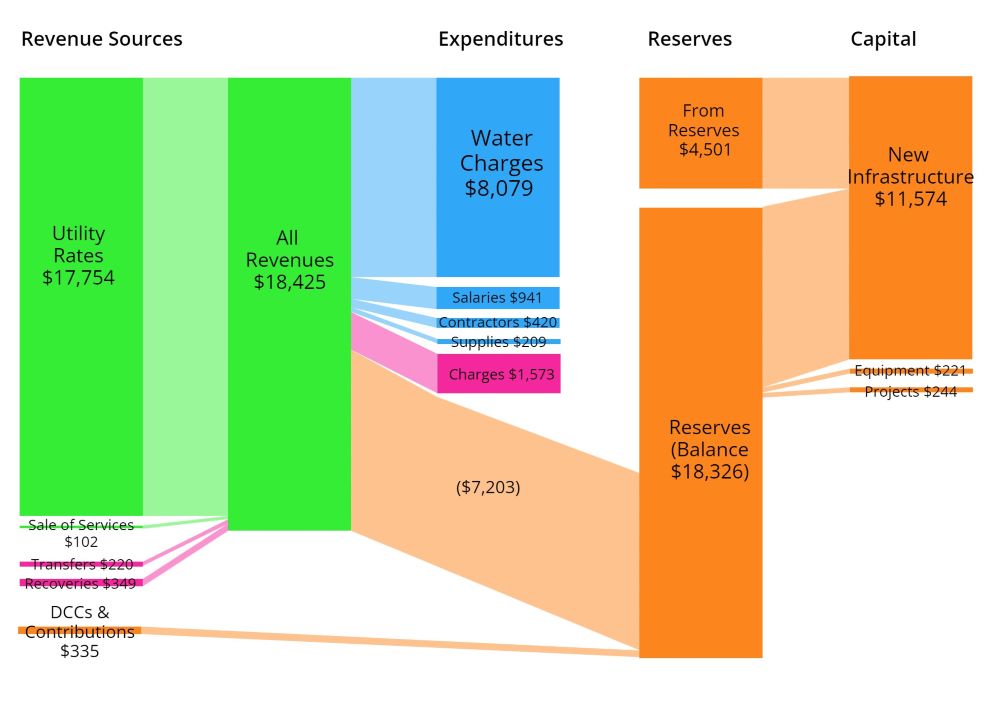

Again, our main source of revenue is utility rates, and the DCC/contribution part is much smaller in water this year. That has mostly to do with the timing of capital projects and our success at getting senior government grants for sewer work more than water work. Of the $18.5 million we take in, about 44% goes directly to Metro Vancouver to pay for the water. We spend less than 10% of our budget on operations, though with internal charges (the money other city departments charge the water utility for services), this cost is a bit higher than in sewers. Garbage and recycling are bit different than the other utilities, as the level of service provided to different parts of the community (house vs. strata, home vs. business, etc.) varies quite a bit, and although disposal charges handed down (mostly from Metro Vancouver) for taking in our waste still eat up almost 40% of all of our revenues, there is a much larger operational cost to solid waste. We need staff to drive those trucks and fuel for the trucks, because you can’t put your trash in a pipeline.

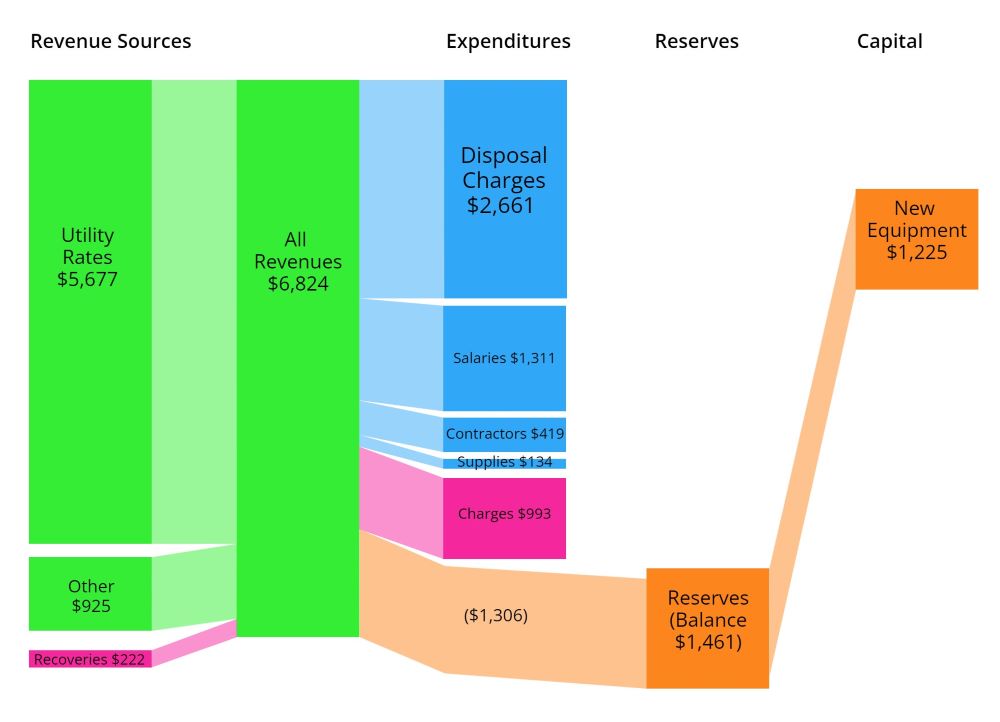

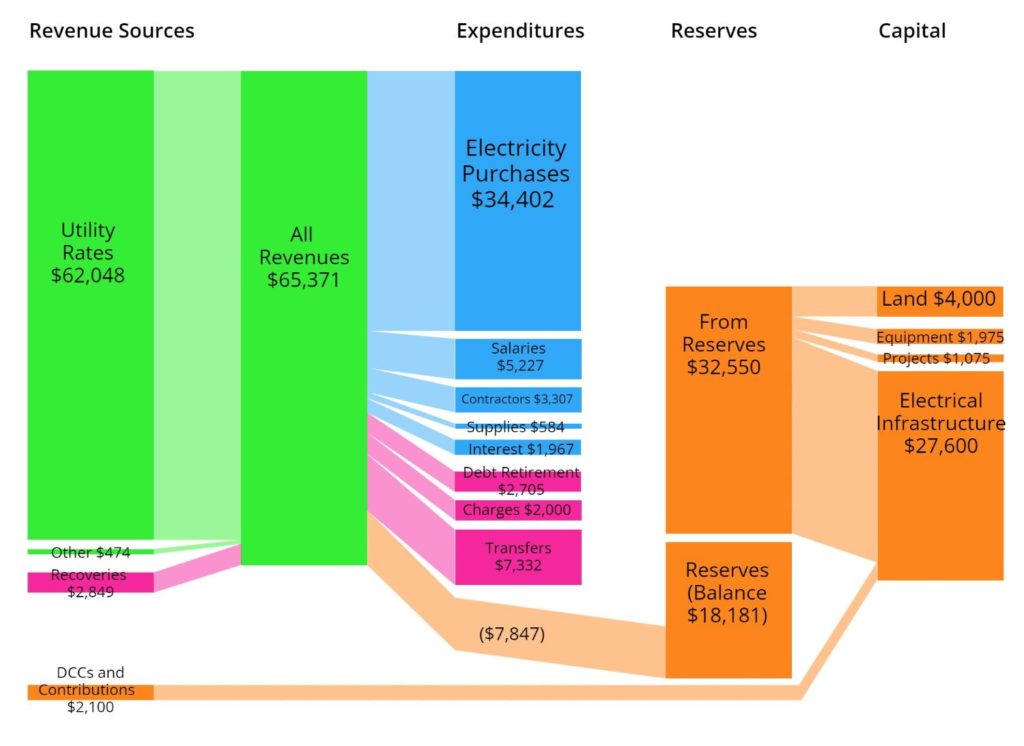

Garbage and recycling are bit different than the other utilities, as the level of service provided to different parts of the community (house vs. strata, home vs. business, etc.) varies quite a bit, and although disposal charges handed down (mostly from Metro Vancouver) for taking in our waste still eat up almost 40% of all of our revenues, there is a much larger operational cost to solid waste. We need staff to drive those trucks and fuel for the trucks, because you can’t put your trash in a pipeline. Our Electrical Utility has a few unique aspects, but it functions like the other utilities we have. The electricity we purchase at wholesale from BC Hydro costs us just over half of our overall revenues, and the cost of day-to-day running of the utility costs about another 17% (or a little over $11 million). This leaves us with about a third of income that goes into our Capital Reserves or directly to the City as transfers. The transfer number here is large because it includes the dividend the City takes every year from electrical utility operational surplus and puts it in the general operational fund. This amounts to about $6 million that the City uses to offset property taxes in providing services that we otherwise wouldn’t be able to deliver.

Our Electrical Utility has a few unique aspects, but it functions like the other utilities we have. The electricity we purchase at wholesale from BC Hydro costs us just over half of our overall revenues, and the cost of day-to-day running of the utility costs about another 17% (or a little over $11 million). This leaves us with about a third of income that goes into our Capital Reserves or directly to the City as transfers. The transfer number here is large because it includes the dividend the City takes every year from electrical utility operational surplus and puts it in the general operational fund. This amounts to about $6 million that the City uses to offset property taxes in providing services that we otherwise wouldn’t be able to deliver.