Regular readers (Hi Mom!) know I like to define my terms. Almost to a fault. That is how a 300-word missive on the latest outrage can expand into a 1500-word explanation of some nuanced difference in language.

Here we go again.

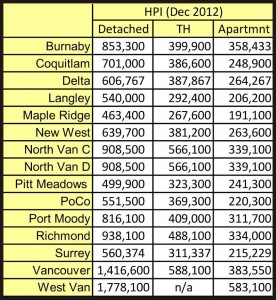

With the BC Assessment Office returning this year’s assessment reports, and everyone able to look up their own house (and that of their neighbour) using the on-line tool, the Cities will now be able to set their “Mil rates” (or less correctly but more commonly, “Mill Rates”) and the Cities can all brag or their citizens can lament about being the highest or lowest taxes municipalities. Ironically, West Vancouver can claim both titles, and here is where defining our terms is so important.

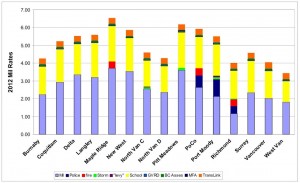

Property taxes are calculated using a slightly complicated formula, based on three factors: the value of your property, the value of the other properties in your tax area (that is, across your municipality), and the Mil Rate established by the Municipal government. There are some other complicating factors, such as the multipliers used for non-residential properties (Commercial and Industrial properties pay 3-10x as much as residential properties for the same assessed value), and the Homeowners Grant which reduces the effective tax rate for lower-value properties, but really, it all circles around the Mil Rate.

How the Mil Rate is calculated is rather simple. The Municipality figures out in its annual budget how much money it needs from property taxes to operate over the upcoming year, we’ll call that “Taxation Income”. It is then told by the BC Assessment Authority what the “Total Assessed Value” is of all taxable properties in the City. The first number is divided by the second, multiplied by 1000 (hence the “Mil”) and the result is the Mil rate.

So if we imagine a City where there are 100 houses all worth $100,000, their Total Assessed Value is $10,000,000. If the City needs $30,000 to operate, the Mil rate will be 3. We can easily calculate from this that every homeowner will pay $300 in property tax ($30,000 / 100), or $3 per every $1000 of house value.

Now imagine a City where there are 100 houses, but 9 of them are worth $500,000, one of them is worth $100,000, and the remaining 90 are worth $60,000 each. Same number of houses, and the same cost to run the City, so the Mil rate will stay at 3. The Lucky Duckies in the mansions will pay $1500, the guy in the $100,000 house pays the same $300, but the median homeowner will pay $180. Mil rate is the same, the average tax is the same, but the median tax is lower.

Back to the first City. If the Council decided it needs to raise property taxes by 5% to maintain services demanded by its residents, they now need $31,500 in tax revenue. If no-one’s house value increases, the mill rate is 3.15, and they all pay $315. If their properties all go up in value by the same 5%, then they all have $105,000 properties, the Mil rate stays at 3, and they all pay $315.

Just for the fun of it, imagine a City that is similar to the first one, but due to a freak of geography, every house has a spectacular view of the sun setting over the ocean and cold beer springs from the back yard fountains. Because of this, all of the properties have values of $200,000. However, the sea-air and beer runoff erodes the roads, and the City needs $36,000 per year to operate. The mill rate would need to be 1.8, and each homeowner would pay $360. So does that City have higher or lower taxes than the first City?

These examples are ridiculously simple, of course, but they demonstrate the point, when comparing taxes between cities you need to compare apples to apples and oranges to oranges.

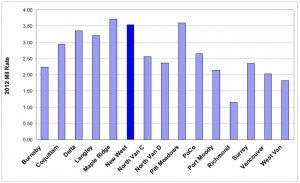

The Mil Rate for residential property in New Westminster in 2012 was 3.5441. This compares to other municipalities across the Lower Mainland from 1.81 (West Vancouver) to 4.73 (Abbotsford ). Vancouver was 2.02. Across-the-board comparisons show New Westminster’s Mil Rate is higher than most, but certainly not the highest in the Lower Mainland.

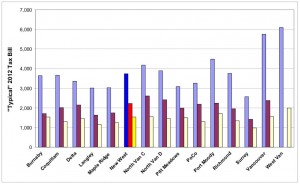

But how do our actual taxes compare?

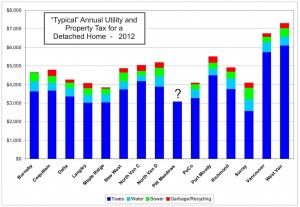

The average assessed value for residential property in West Vancouver is just under $2 Million. The average assessed value for property in New Westminster is about $550,000, so for the average homeowner, West Van taxes are $3,620; in New Westminster the same calculation is $1,949. Not even close.

Another way to estimate is to compare BC Assessment numbers with 2011 Canada Census data (different ways of counting and different estimates mean different numbers, but the trend/scale is the same):

New West:

Total value: $13 Billion,

Mil Rate: 3.5441

Tax Collected: ~$46 Million (not counting commercial/industrial).

Households: 30,585

Population: 65,976

Tax per Household: ~$1,500

Tax per Person: ~$700.

West Vancouver:

Total value: $30 Billion,

Mil Rate: 1.81

Tax Collected: ~$54 Million (not counting commercial/industrial).

Households: 17,070

Population: 42,694

Tax per Household: ~$3,160

Tax per Person: ~$1,250.

No matter how you cut it, West Vancouver people pay more in property taxes, despite their lowest-in-the-region Mil Rate.

For the City of Vancouver, their ~$1Million average assessed value and 2.02 Mill rate puts them somewhere between New West and West Van.

A friend recently asked me why they pay more for taxes on a $650,000 house in New West than their friends pay for their $900,000 house in East Van. This is a good question, and probably the real cause for the common (incorrect) complaint that New Westminster taxes are higher than anywhere else. The simple solution turns out to be a little complex. Again, let’s use the West Vancouver comparison. From Canada Census data, here is the distribution of housing types:

New West:

Single/ Semi detached (18.6%)

Townhouse (4.1%)

Highrise Apartment (30.5%)

Lowrise apartment (46.6%)

West Vancouver:

Single/Semi detached (61.0%)

Townhouse (2.1%)

Highrise Apartment (20.2%)

Lowrise apartment (16.8%)

Note the highlighted lines: almost half of New Westminster households are in apartments of less than 5 stories: the majority of them in those three-story walk-ups that pepper the Downtown and Brow of the Hill Neighbourhoods. Less than 20% of households are in single detached homes. Compare that to West Vancouver, where the vast majority are single detached.

Yet the things Cities pay for: roads, sidewalks, police, fire, parks, recreation, infrastructure, etc. are needed by all, whether they live in a two-bedroom apartment on the 2nd floor or a 5,000 square foot house on an acre lot. Those costs index to population, not property value. So in New West, we have more people in lower-value housing, and consequently paying less tax.

So my friend has a $650,000 house in Glenbrook North that may be similar to her friend’s $900,000 house on Renfrew Street, but the relative value of her house ($100,000 higher than the community average) is much higher than her friend’s ($100,000 below the community average), and therefore she carries more of the tax burden for the community.

It might not seem fair, but I cannot imagine the alternative. We could cut Property Taxes in New Westminster to the same Mil Rate as Vancouver, but that would reduce our City budget by more than a third, resulting in a catastrophic reduction in services and infrastructure, which would reduce our property values more, widening the Property Value gap between us and Vancouver, and further choking City Hall of money. That seems a vicious cycle to enter.

Another way to look at the problem, of course, is to recognize that you pay $650,000 for a house in Glenbrook North that would cost you $900,000 off of Renfrew. That $250,000 savings is about 200x the annual increase in taxes you pay in New Westminster, not to mention the savings in borrowing costs for the much less onerous mortgage required.

So do we pay too much property Tax in New Westminster? We don’t pay the most in the Lower Mainland (by any measure) or the least (by any measure). And you can always move to West Vancouver and enjoy paying both the lowest and highest property taxes in the region.

The second debate that happens this time of year is the “fairness” of the assessment process. When Real Estate sales are dropping off and everyone is confidently predicting the long-predicted bursting of the housing bubble- how is it possible that the Assessment Office calculated a modest rise in real estate value for New West?

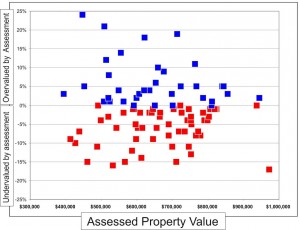

For the fun of it, I entered my address into the BC Assessment search engine, and asked for all local “sales” in the previous year. It returned the 100 nearest properties (all detached homes) that sold in 2012, ranging from $383,000 to $2,500,000 in sale price. I don’t know how “local” they were, but they were all in New Westminster. Then I compared their sale price to the assessed value. The results were interesting.

NOTE: First off, I tossed one property out of the dataset, as it was both the most expensive sale ($2,550,000) and it sold for a shocking 56% premium over its assessed value ($1,631,700). This was a large property in Ewan Ave in Queensborough, with its single home no doubt about to be torn down and replaced with row-houses or an apartment building. It was so anomalous, I needed to remove it to fit the graph below.

For the remaining 99 properties, I plotted the assessed value on the x axis, and the percentage difference between the sale price and the assessed value on the y axis, and the result is informative, if not interesting, in that there is basically no pattern:

If the assessment authority was systematically underestimating property value, the cluster would be predominantly below the 0% line; if it was overestimating, the cluster would be above the 0% line. In reality, the centre of that cluster is just below the line- the Assessment Authority undervalues all property near my house (relative to the resale market) by about 1.4%. (I’m assuming this has to do with my playing Tom Waits loudly all hours of the day and night). Overall, there are 62 properties undervalued, 36 overvalued, and one exactly valued. However, the majority of properties are assessed within 4% of their market value.

Note, there is not much “slope” to the cluster, the authority does not unfairly value expensive properties relative to inexpensive values in any significant way. The average assessed value of every property below the line is $685,000, and the average assessed value of those above the line is $665,000. So although it is not visible in the data, there is a slight(1.5%) shift of assessed value from expensive homes to less-expensive ones.

All that said: if I was to characterize the cluster, I would call it high accuracy, low precision. There are more than 20% of properties that are off (plus or minus side) by more than 10%. That means a large number of people are paying $200 a year more – or less – than they “should”. However, you should rest assured that you are more likely (ever so slightly) to be paying less in taxes than your share according to the BC Assessment Office.